According to the Corporate Finance Institute, behavior finance is: “the study of the influence of psychology on the behavior of investors or financial analysts. It also includes the subsequent effects on the markets. It focuses on the fact that investors are not always rational, have limits to their self-control, and are influenced by their own biases.”

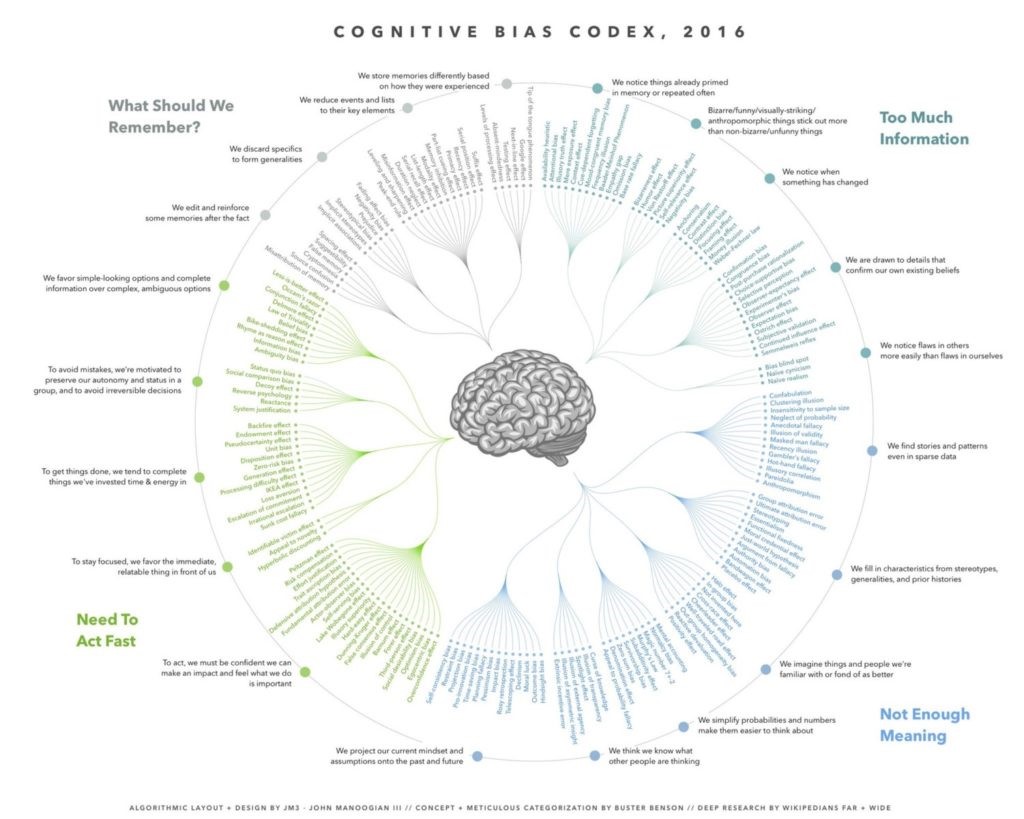

The incredible chart nearby shows an exhaustive, categorized listing of all of the biases that can influence investors. These include things like:

- Availability heuristic

- Hot-hand fallacy

- Expectation bias

- Murphy’s law

- And 171 others

Click here to go to the blog post (not mine) that included this graphic in all its full-size splendor.

Recently, I was cleaning out my office in-box and found some notes I had made about one of these human foibles, called the Possibility Effect. Call it serendipity, call it God, or call me lazy for not cleaning out my in-box until now, but the Possibility Effect is an incredibly timely topic given the current situation.

The Possibility Effect, per my note, is explained below. See if this sounds like how you and others are feeling about the situation.

When an outcome is possible but not probable, people tend to overestimate its chance of occurring.

List of conditions in which investors are vulnerable to overweighting low probabilities and becoming biased by the possibility effect:

- Vivid or easily imagined results

- Minimal awareness about the event’s likely outcomes

- Minimal investor conditioning or experience with such events

- Event is represented as a relatively novel/unique phenomenon

- Desiring, wanting, or needing the outcome to occur

- Feeling a personal or emotional stake in the outcome

- Feeling excited or fearful about the event happening

- Ambiguous information about the event

So, what’s the big deal? Where’s the problem?

Simple—our minds can run wild and construct scenarios that are possible but have little chance of happening. From those scenarios, we make decisions that are foolish, and which could later have a huge impact on our futures. For example, I just spoke to a friend who said his dad bailed out of stocks in the financial crisis and now is in bad financial shape because his investments never had a chance to recover.

Most importantly, be aware and then wary of the Possibility Effect and how it might impact your decision making. Use these tools to combat it.

Ask yourself…

- How do I know that’s true?

- What happens if I’m wrong?

- What are the odds that I’m right?

- Have I read anything that disagrees with my thinking?

If you’d like to learn more about behavioral finance and why it’s so important, click here to go to a nice blog post (also not mine) on the subject.

We’ve published other posts about behavioral flaws and cognitive bias. Now might be a good time to revisit them:

- Hindsight Bias

- The Dunning-Kruger Effect

- Conjunction Fallacy

- Recency Bias

- Confirmation Bias

- Mental Accounting

- Outcome Bias

Securities offered through LPL Financial, Member FINRA/SIPC.