A QCD is a qualified charitable distribution.

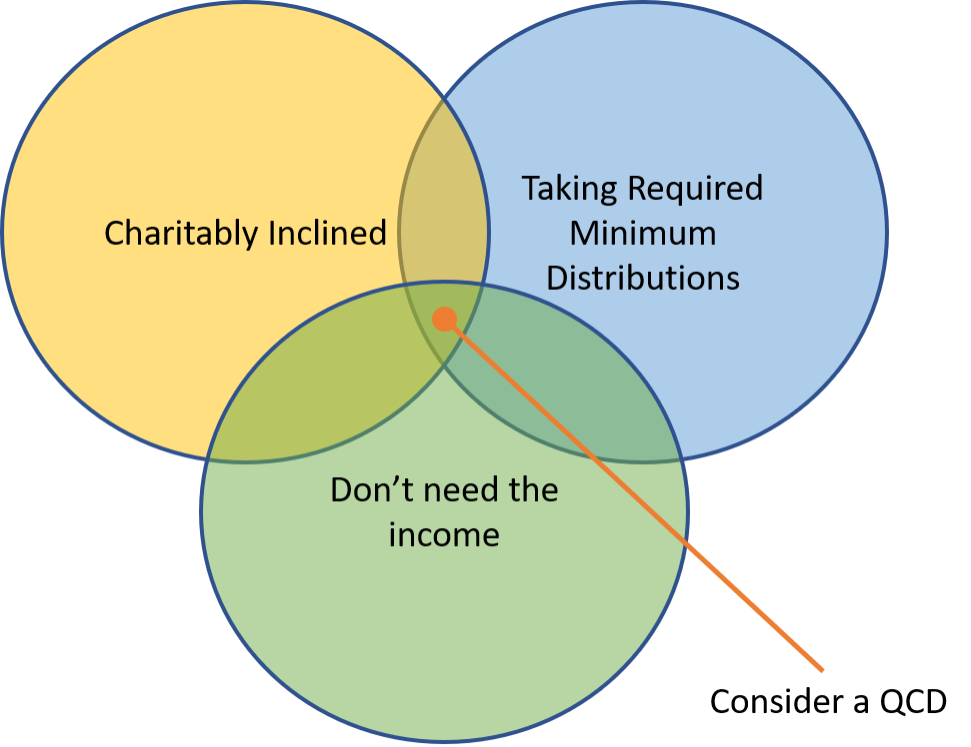

It’s a basically an otherwise taxable distribution from an IRA that is paid directly to a qualified charity. Importantly, it can be used to satisfy your required minimum distribution if you’re required to take them and don’t need the income.

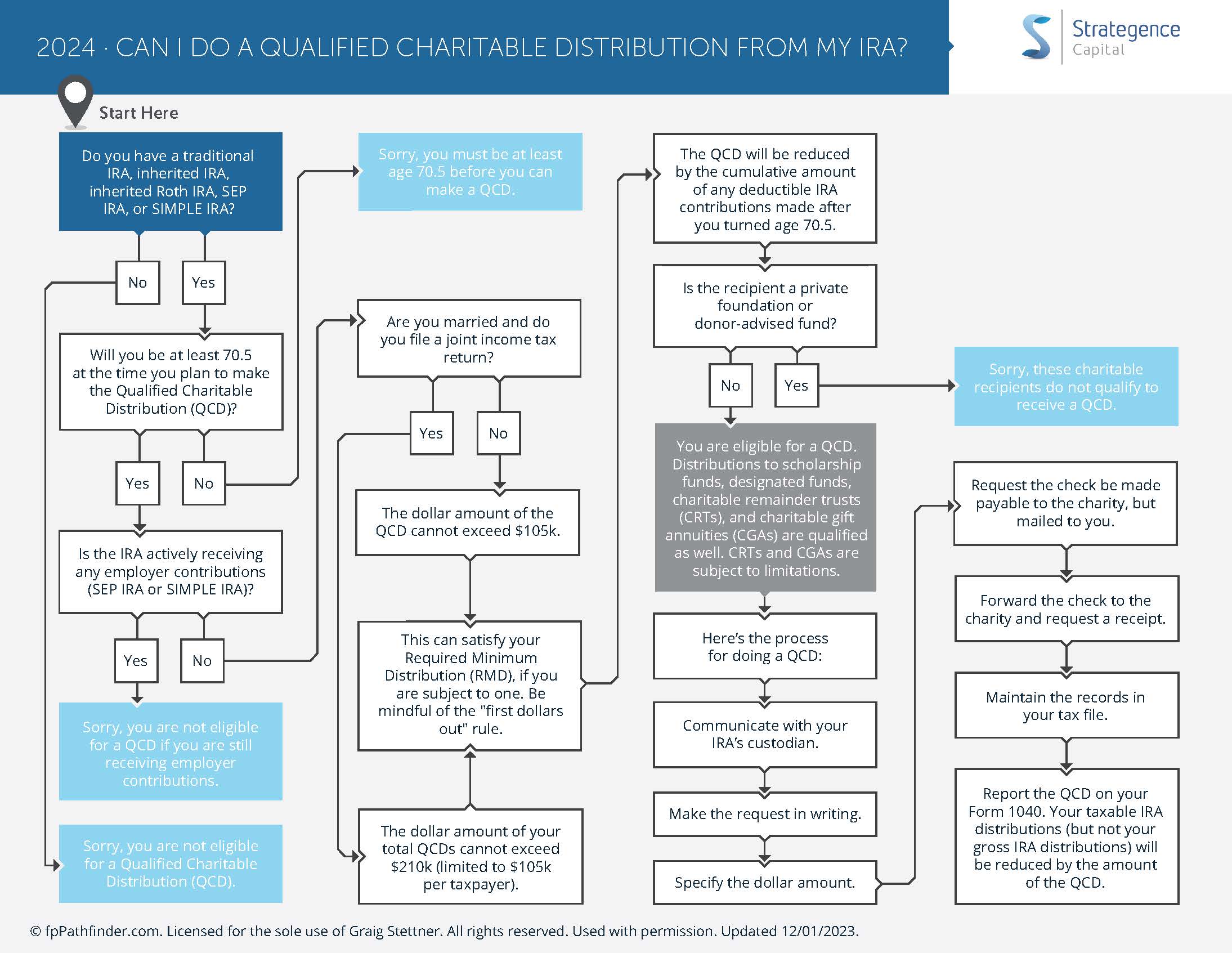

You will need to talk to your tax professional, but if the Venn diagram here describes you, consider making a QCD. In addition, we have included below a flowchart to help you determine if a QCD might make sense for you. As always, our team is just a phone call away if you are after more advice or insight about your specific situation.