Morningstar recently published a report, “Mind the Gap 2024,” which is a report it has been publishing for the last ten years. Its findings have largely remained unchanged: investors underperform the very funds they’re invested in.

How can that be?

Timing.

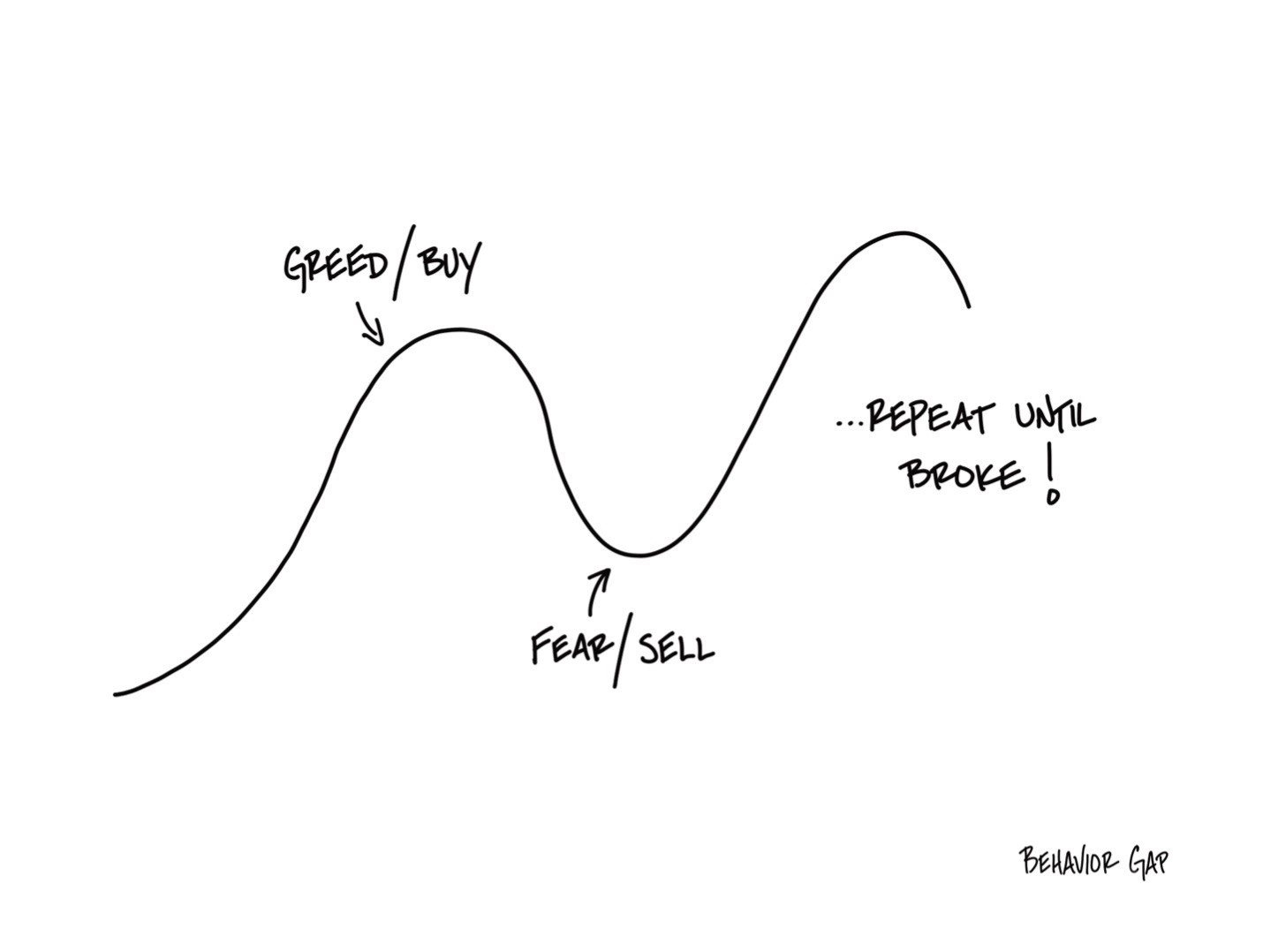

Basically, most investors buy high and sell low—or at least they tend to. A good financial advisor can help counter this impulse.

A note for the curious (and Enneagram 5s)…

The phrase “mind the gap” originated in the London Underground (also known as the Tube) rail system. It was introduced in 1969 as a warning to passengers about the space between the train door and the station platform. (source: claude.ai).

In the 2024 study, Morningstar found that the average fund return was 7.3%, while the average investor’s return was 6.3%, a 1% gap, but a 13% (7.3% to 6.3%) reduction in return. According to Morningstar, “the 1.1% “gap” is explained by the timing of investors’ purchases and sales of fund shares.” Morningstar drilled down further and found that certain types of funds had different gaps. Allocation funds, those that invest in a mix of assets, say, stocks and bonds, had the lowest gap, at 0.4%. Sector funds—think of a fund invested just in technology stocks—had the widest gap, at 2.6%.

Of the last ten years studied—each study has covered the previous ten years—2020 was the worst. Morningstar found that, “investors particularly struggled to navigate 2020’s turbulence, adding monies in late 2019 and early 2020, then withdrawing nearly half a trillion dollars as markets fell, only to miss a portion of the subsequent rally.”

Does this describe you?

We find that this illustration describes investor behavior well—and we understand it well.

It’s easy and feels good to invest when markets do well. We enjoy logging on to see rising account values, and the opposite is true. The easy thing to do when markets decline is to sell investments, to not look at updated account values.

But this may cost you. We think a better solution is to find a mix of investments (asset allocation) that is likely to help you reach your long-term goals and to periodically rebalance to that asset mix. Between rebalances, ignore the stories that produce fear or greed in you (noise.) We have an easy formula for this.

Click here to schedule a time to talk to us about this.

OneAscent Financial Services, LLC (“OAFS”), d/b/a Strategence Capital, is a registered investment adviser with the United States Securities and Exchange Commission. OAFS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by OAFS or any unaffiliated third party. OAFS is neither an attorney nor accountant, and no portion of the presented content should be interpreted as legal, accounting, or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.