Diversification proved valuable in 2020.

It was a roller-coaster year, to be sure, but staying the course again proved to be a good strategy. Many investors responded to the COVID outbreak by moving to more conservative allocations. Others cited the 2020 Presidential election and the narratives they created around it as reasons to change allocations. We continued to preach a sermon about sticking to long-term investment plans with rebalancing when investments strayed from their target allocations.

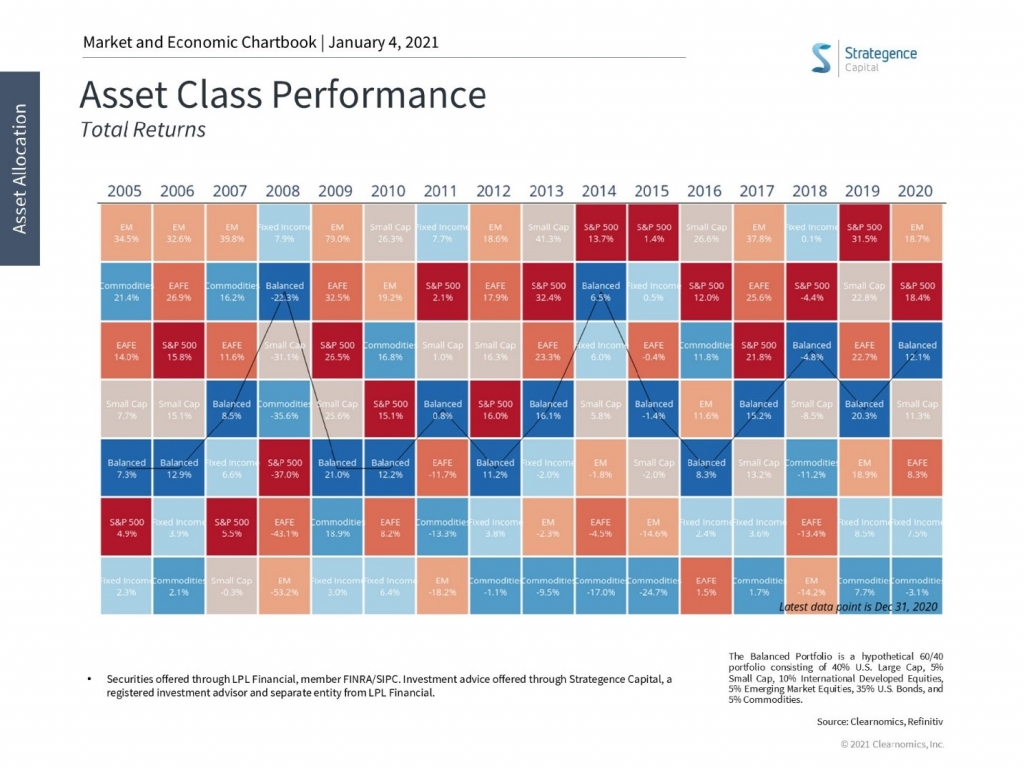

The quilt chart above shows the performance of six asset classes and a hypothetical 60/40 (stocks/bonds) portfolio. It showed the S&P 500 staying in the top three for the eighth year in a row, but the top-performing asset class was Emerging Markets stocks (EM on the chart). The 60/40 portfolio remained a good way to invest, muting, as it does the moves of the best and worst asset classes.

Going into 2021, our advice remains the same

Invest in a portfolio at the intersection of your risk tolerance, required risk, and capacity for risk, a subject explored in greater depth in this blog post.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes.

Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indexes are unmanaged and an individual cannot invest directly in an index. Unmanaged index returns do not reflect fees, expenses, or sales charges.

S&P 500 – The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the emerging market countries of the Americas, Europe, the Middle East, Africa and Asia. The MSCI EM Index consists of the following emerging market country indices: Brazil, Chile, Colombia, Mexico, Peru, Czech Republic, Egypt, Greece, Hungary, Poland, Qatar, Russia, South Africa, Turkey, United Arab Emirates, China, India, Indonesia, Korea, Malaysia, Philippines, Taiwan, and Thailand.