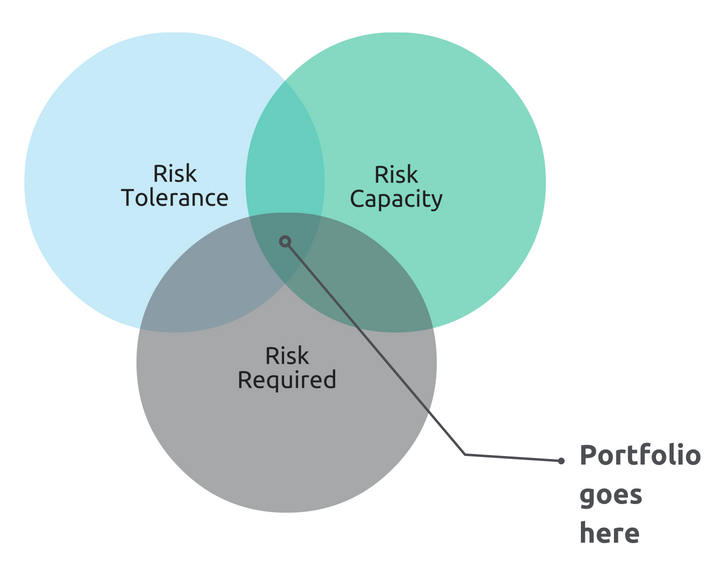

Risk Tolerance + Risk Capacity + Required Risk = Risk Profile

Risk Tolerance + Risk Capacity + Required Risk = Risk Profile

Have you ever taken a risk tolerance questionnaire that purports to tell how you should allocate your portfolio (they’re all over the internet) or been told that you have to know your risk tolerance before you can choose an appropriate portfolio? In fact, risk tolerance is only one-third of what needs to be considered before you can select a portfolio. There are three factors, in toto, that need to be considered, and here they are.

- Risk Tolerance – according to FinaMetrica, this “is an individual’s general willingness to take risk (potential loss) towards achieving their financial objectives. It is the amount of risk or the degree of uncertainty that they are comfortable taking.” This has been found to be relatively stable over one’s lifetime, unlike the two following elements.

- Risk Required or Risk Needed – again, according to FinaMetrica, this is “the risk associated with the return required to achieve an investor’s goal.” In other words, how much risk do you need to take to earn that retirement in Tahiti?

- Risk Capacity or Capacity for Loss – FinaMetrica says this is, “is the extent to which worse than anticipated outcomes can be absorbed without impacting the achievement of important goals.” Or this could be the risk that you have a hand-lettered cardboard sign as your retirement calling card.

No one of these is sufficient. Consider the last one…it’s important to consider whether one’s portfolio risk could have you staking out a spot at the shopping mall parking lot entrance. And what if one needs to take more risk (#2) than he or she is comfortable with (#1).

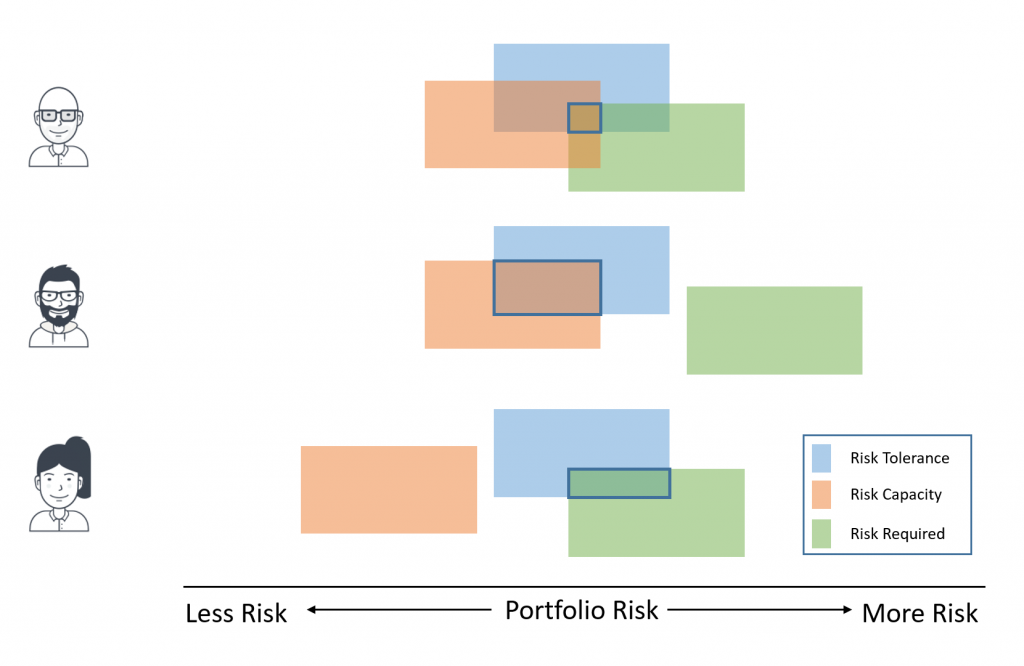

Here are three graphical examples of these three elements in three different scenarios. In each of the examples below, the subject has the same risk tolerance; only the risk required and risk capacity are different. In economics, when concepts are graphed, it’s important to observe where lines intersect and are tangential. In a like vein, the important points in the image below is where there is and isn’t overlap.

The top example is the only one of the three where there is overlap amongst all three elements, and that means there is probably a portfolio that would have been, historically, able to satisfy this individual’s needs. The allocation is likely to produce volatility that is emotionally tolerable (it’s in the blue box); that satisfies, although just barely, the individual’s need for risk to meet goals (it’s in the green box); and historically, it would have produced results that would not have impoverished our individual (it’s in the orange box), although it’s near the highest level of risk capacity.

In the middle case, our individual has overlapping risk tolerance and risk capacity, meaning that there is probably a portfolio that won’t be too volatile (in the blue box) and that likely won’t impoverish the individual (the blue and orange boxes overlap.) For whatever reason, however, the individual’s need for risk—maybe his goals are too lofty or he hasn’t been saving enough—is much higher than his risk tolerance, and the possibility exists that some historical results of this portfolio might have been enough to devastate or seriously impair his financial well being (there’s no overlap of the green box with the others.) The ideal solution is probably not pleasant, as it means that, in some way or another, some goals are not likely to be reached; that is, the portfolio’s risk/return profile is going to have to be dialed back to accommodate the other elements.

The bottom case is a version of the second, only this time, there is overlap between risk tolerance and risk required (blue and green squares overlap), but both represent allocations, the historical results of which would have been likely to, again, damage financial well being. Again, the ideal solution is not ideal, with the same remedy as case #2.

So the next time you have an opportunity to answer a five-question risk tolerance questionnaire with the promise that you’ll be able to properly allocate your portfolio, think thrice.

The examples presented are hypothetical and are not representative of any specific situation. Stock investing involves risk including loss of principal. No strategy assures success or protects against loss.