Meet TRINA, TINA’s sister

I might be wrong, but I think it was Strategas Research Partners which coined the term, TINA, shorthand for There Is No Alternative…to stocks. Traditionally, the two main, competing asset classes are stocks and bonds, and in this two-asset class dichotomy, you could change Tina to TRINA, there really is no alternative.

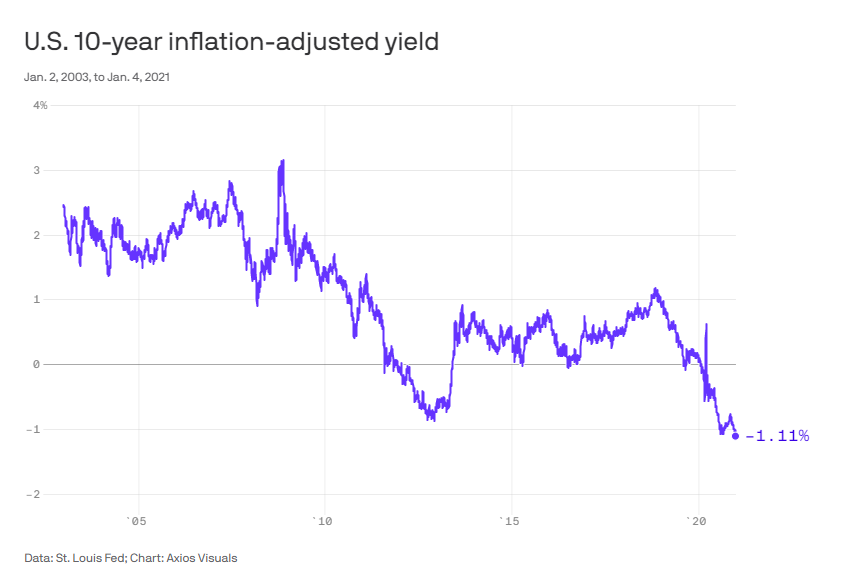

Take a look at the inflation-adjusted yield on the 10-year Treasury note in the chart below. Investors in it, are likely to end up with less purchasing power than when they started. (Click the chart to be taken to the Axios story on this.)

With bonds traditionally the less volatile of the two asset classes—and U.S. Treasuries the world’s safest securities with respect to default risk—there are, admittedly, riskier and thus, higher-yielding bond types, but Treasuries anchor yields, and other bond types will only be slightly more attractive than Treasuries.

Regardless, this scenario forces investors to say there really is no alternative and, thus, I must invest elsewhere. Where can I invest, instead? The front cover of this week’s Barron’s magazine suggests some alternatives… “energy pipelines, dividend stocks, and real estate,” none of which have a risk profile anything like bonds.

Unfortunately, there is also no alternative to holding investments that match one’s risk profile, which is a subject we discuss in the blog post here.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

Past performance is no guarantee of future results.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.