Happy summer to you, dear reader.

One of the fancy-sounding things that seems to be required for every financial advisor or money manager, and/or his/her website, is an investment philosophy, which is basically one’s investment worldview; that’s it; nothing fancy.

Our investment philosophy can be neatly summed up like this:

Strategic Asset Allocation + Rebalancing – Noise

That is, we try to find a strategic—fancy for long-term—mix of assets that we think has a high probability of meeting a client’s long-term goals. Periodically, we rebalance the portfolio to that mix, assuming that, with the passage of time, there isn’t a more appropriate mix. Finally, we ignore the noise, which is the internet, print, and TV chatter about investments. Implicit in this approach is that we don’t, as they say, try to time the market.

Every once in a while, though, it’s easy to think one should have seen something coming—that something was so obvious, that one could have steered one’s portfolio to investment success. (That, of course, is an example of Hindsight Bias, which you can read about here, in a brief write-up we did.) Maybe, once in a while, you even think you could have sold at the top or bought at the bottom. After all, someone had to (which sounds like a lot of thinking that surrounds the lottery: someone has to win.)

Well…here’s your chance, the Market Timing Game

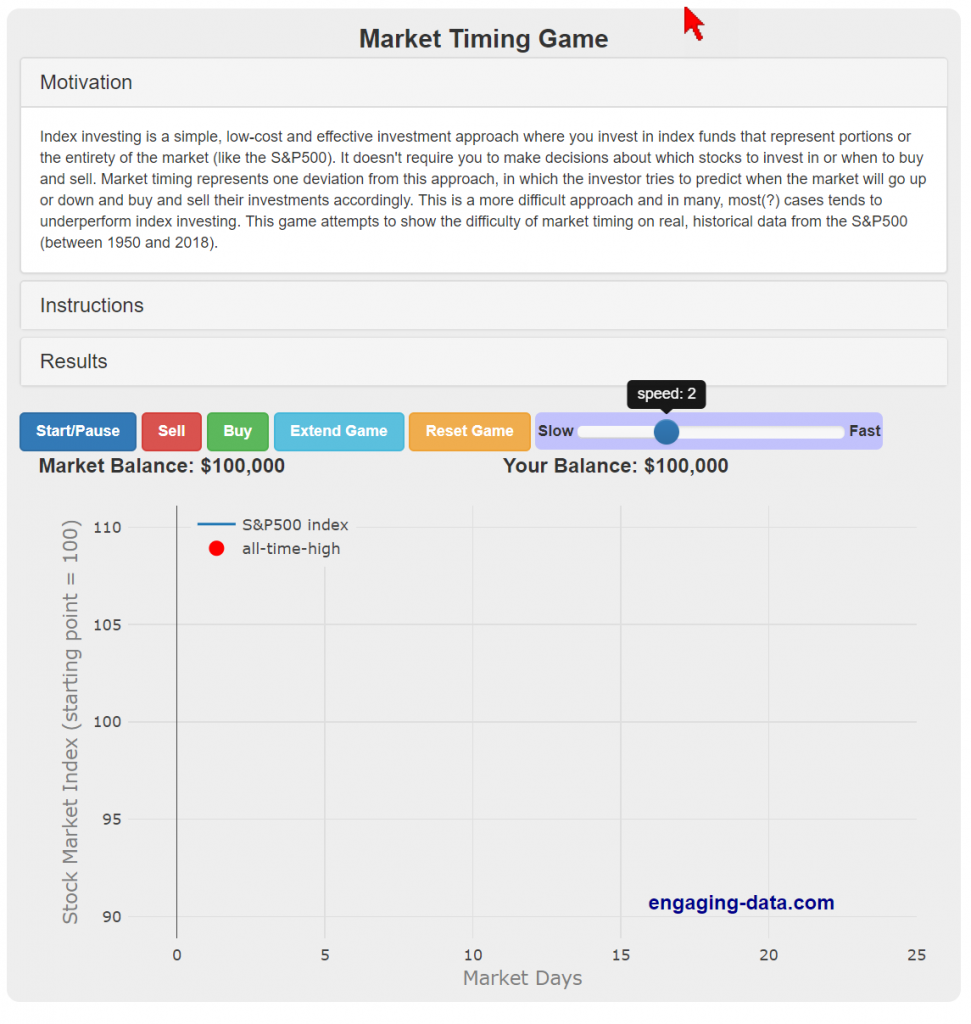

I’ve included, on the left, a screen shot of the game, which you can access by clicking here. It’s a self-explanatory interface. One starts with $100,000 of capital, which starts off invested in the S&P 500 index. Your balance is shown, and the market balance is shown. Naturally, one hits the start/pause button to begin. As soon as you click the Sell button, you’re timing the market, and your balance will differ from the market’s. If you never hit the Sell button—or until you do—you’re a buy-and-hold investor. The game uses real market data for the S&P 500, and you will be investing during some three-year period between 1950 and 2018. (One can also speed up the simulation and/or extend it.)

I’ve included, on the left, a screen shot of the game, which you can access by clicking here. It’s a self-explanatory interface. One starts with $100,000 of capital, which starts off invested in the S&P 500 index. Your balance is shown, and the market balance is shown. Naturally, one hits the start/pause button to begin. As soon as you click the Sell button, you’re timing the market, and your balance will differ from the market’s. If you never hit the Sell button—or until you do—you’re a buy-and-hold investor. The game uses real market data for the S&P 500, and you will be investing during some three-year period between 1950 and 2018. (One can also speed up the simulation and/or extend it.)

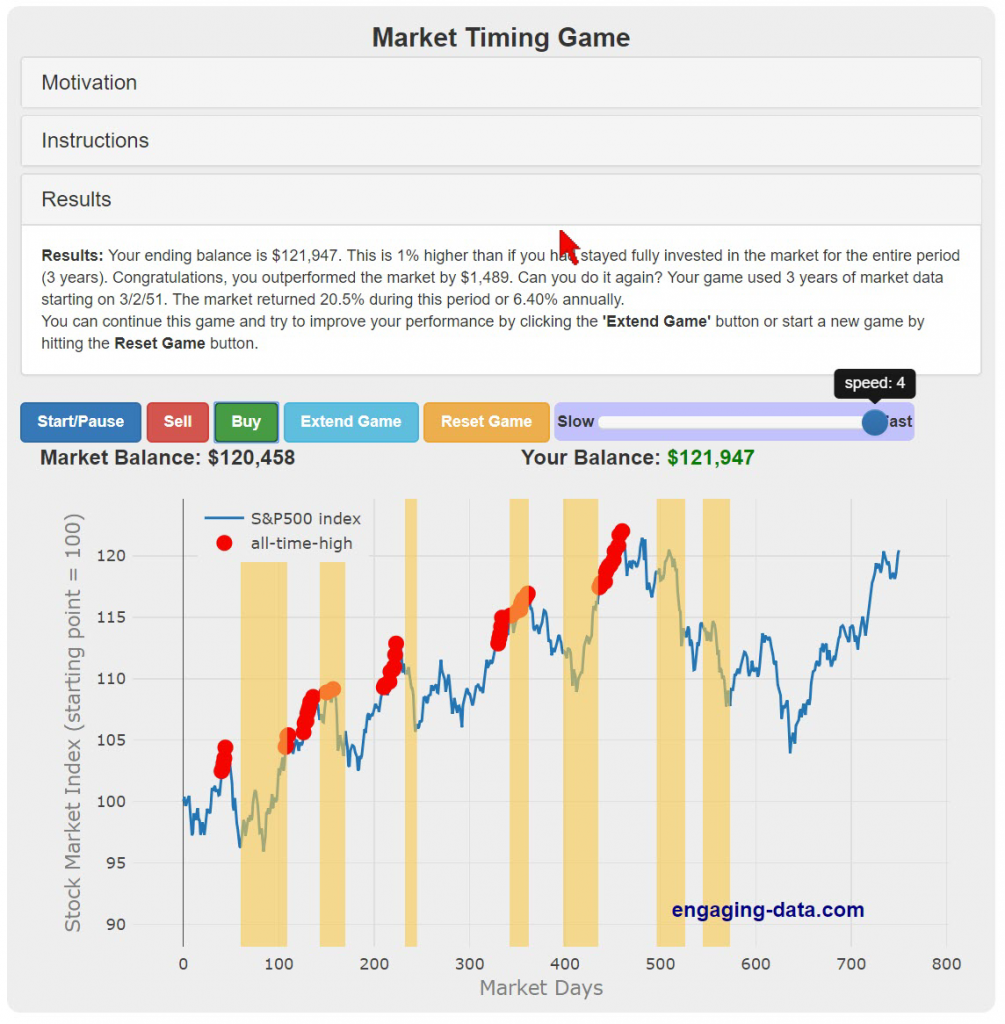

After a couple of tries, I was able to, as they say, “beat the market”…once. I experienced lots of emotions. When I’d sold, and the market went up, I suffered from FOMO, Fear of Missing Out, and wondered about getting back in. I gloated when I was able to miss out on a decline. I thought that anytime I could sell and buy back in at a lower price, I’d do well. That’s pretty much a truism, but the market didn’t always cooperate by going down.

My results are shown on the right…a measly 1% better than the market did, and I didn’t have to pay an advisor a fee, nor did my investments come with expenses. Times when I was not invested are shown in yellow. Look at the furthest right-hand yellow bar. I bought back in on the right side of that, virtually nailing the bottom until, after a head-fake rally, the market went even lower.

I think the question, “can you do it again,” should appear in bold, because I’m certain I lucked into the results and would be hard pressed to repeat them.

Why don’t you give it a whirl? It’s just pretend money, so it won’t hurt your portfolio like actual market timing is likely to. Then, the next time you think you’ve got it figured out, go to the game and put your results on social media. Let us know how you do by sending us an email, as we can’t allow communication through our blog, if you’re reading this there.