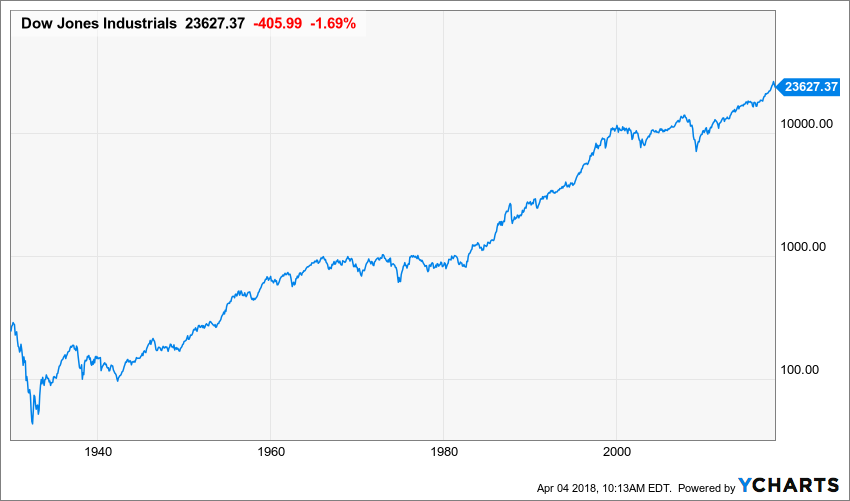

A major reason for investors under-performing indexes and even the funds they invest in is attempts to time the markets. They forget that—cliché alert—time in the markets is better than timing the markets. Recent drops will almost certainly look like minuscule blips on long-term charts of those markets—maybe even imperceptible, as many once-scary drops now appear in this chart.

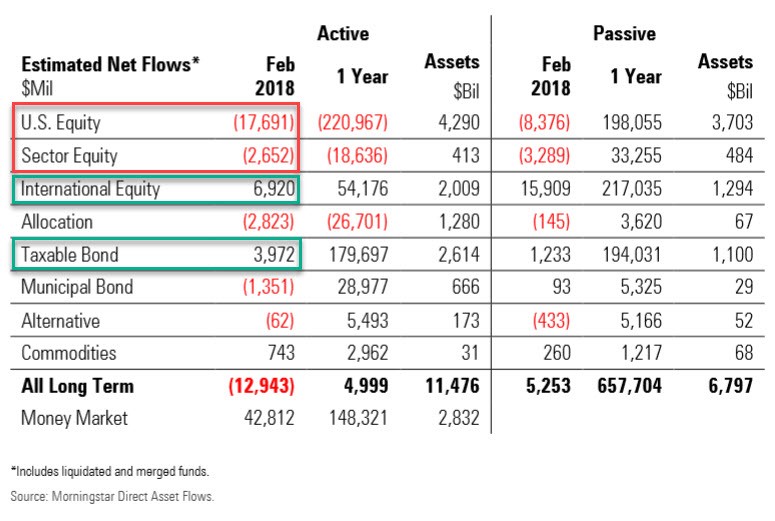

Here is a look at Morningstar’s fund flows from February. Notice that U.S. stocks are sold (red boxes) and what is bought (green boxes) are what’s done well, recently (foreign stocks) and what is less volatile (taxable bonds.)

Timing markets is extraordinarily difficult, and if you think you can do it, you might be suffering from the Dunning-Kruger effect, which is a cognitive bias—deficiency is more appropriate—where “people of low ability suffer from illusory superiority.

We think a far better approach is to thoughtfully determine, with the help of a trained professional, an asset allocation that is appropriate for your risk profile (click here for our blog post on this subject) and re-balance on a disciplined basis.

If you’d like to get off the emotional roller coaster of investments, operators are standing by (click here to email us.)

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.