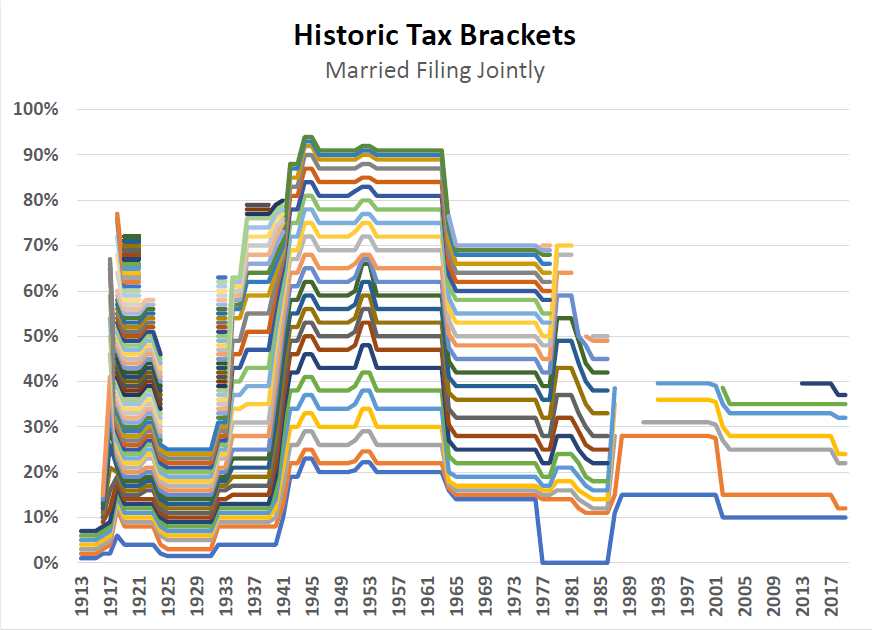

The chart below depicts Federal income tax brackets (married filing jointly) going back to the inception of income taxes as we currently know them. We can quickly make several observations from the chart. First, in the past, there were a lot more tax brackets; and, second, tax rates have been a lot higher than they are presently. In fact, other than prior to World War II and a quick blip in the ‘70s and ‘80s, tax rates have never been lower for each of the brackets.

It’s time to do something about this!

You need to take advantage of this…somehow. So, what can you do? Here are a few suggestions—oh, and check with your tax professional, first:

- Convert some or all of your Traditional IRA(s) to Roth IRAs. A conversion is a taxable event, and the amount converted is considered income. Work with your tax professional so that you don’t convert so much that you get pushed into a higher tax bracket.

- If your income doesn’t preclude you from contributing to a Roth IRA, consider contributing to a Roth IRA, especially if your company’s retirement plan doesn’t offer a Roth option, described below.

- If it’s an option, do an in-plan conversion of some or all of your pre-tax/Traditional 401(k) balance. To maximize the benefit of this, you will need to pay the tax outside of your 401(k), so you will need to have funds available to you. As with the IRA conversion, your 2019 tax return will report the converted amount converted.

- If your employer’s retirement plan offers a Roth deferral option, consider directing a portion or all of your deferral to the Roth option.

- If you are retired but haven’t yet begun taking required minimum distributions (RMD) from your IRA or qualified retirement plan, consider doing so before you’re required to. This may be advantageous if your income is lower between retirement and age 70 ½.

Your tax professional will likely have other suggestions, based on your particular situation.

There’s no telling what 2020 will hold in terms of the White House. While it’s not safe to say that there’s nowhere for taxes to go but up, it certainly seems that the future bias for taxes is upward.

Do something about it!