The Prudent Investor Rule is a legal doctrine that has its roots in the early 1800’s, when it was called the Prudent Man Rule. It guides trustees and others in prudent investment management. A major tenet of it is that, “the trustee has a duty to diversify the investments…” I’ve always considered it a primary duty of an investment manager. Among the reasons for doing so are to avoid the potentially-disastrous consequences of a concentrated (i.e. non-diversified) portfolio.

Diversification is also important because one never knows what asset or asset class will perform best. If one did, then, like Warren Buffett said—and I paraphrase—diversification is for dummies.

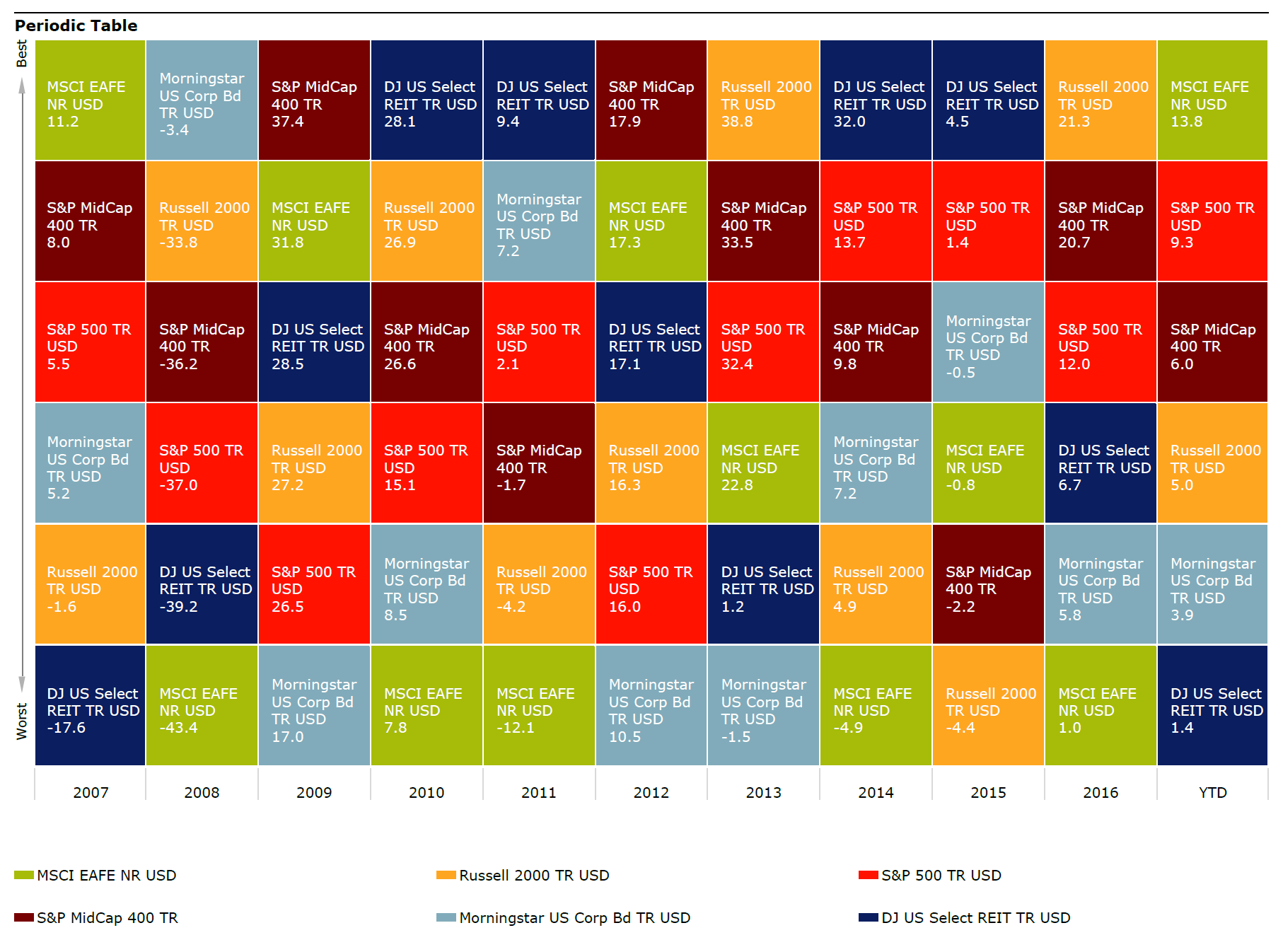

Pictured below is a chart that goes by various names, including quilt chart and table of periodic elements, among others. Along its horizontal axis are the last 10 calendar years and 2017 to date; along the vertical access are arrayed, in decreasing order of performance, six different asset classes.

click to enlarge

The main thing to take away from this chart is that past performance is no predictor of future results, as all of the disclaimers say. A seemingly-common approach of looking at performance over, say, a three- or five-year period to determine where to invest is virtually destined to disappoint. Another way to sum up this chart would be, “every dog has its day,” and the poster child for that is the leading performance of foreign stocks, as measured by MSCI EAFE index (green square), along with the fall from grace of real estate, which held the top position in 2014 and 2015 before falling into the basement in 2017.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All indices are unmanaged and may not be invested into directly. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. No strategy assures success or protects against loss.

Stock investing involves risk including loss of principal. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. The prices of small and mid-cap stocks are generally more volatile than large cap stocks. Bonds are subject to interest rate risks. Bond prices generally fall when interest rates rise. Investing in Real Estate Investment Trusts (REITs) involves special risks such as potential illiquidity and may not be suitable for all investors.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P Midcap 400 Stock Index is an unmanaged index generally representative of the market for the stocks of mid-sized US companies.

The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell 3000 index.

The Morningstar US Corporate Bond Index includes US corporate bonds with maturities of more than one year and at least $500 million outstanding.

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

The Dow Jones U.S. Select REIT Index tracks the performance of publicly traded REITs and REIT-like securities and is designed to serve as a proxy for direct real estate investment.