Morningstar just released its annual Mind the Gap study. Get your own copy of the report here. “Mind the gap” originated on the London Underground in 1968. The phrase was created to warn passengers about the dangerous space between train cars and station platforms, particularly at curved stations where the gap could be several inches wide.

The gap that Morningstar wants you to mind is the gap between fund returns and investor returns. The gap arises when investors take action in their investment portfolios.

For example, take an investor in one of the more–if not most–popular technology-heavy funds, the Invesco QQQ Trust, which tracks the performance of the NASDAQ 100 index, pictured below. The fund return is the return of the fund, based on an investment at the beginning of a time period. The investor return, on the other hand, reflects the investor’s investment decisions in the fund, like freaking out over the Tariff Tantrum in April, bailing out, and getting back in later.

The good news about the study is that the gap has narrowed over the time that Morningstar has been doing the study. Based on 2024 data, the gap was 1.2%. Over 2019-2021, the gap was 1.5%+.

The report looks at the gap across different types of funds, from municipal bond funds to international funds to sector (i.e. non-diversified funds.) Not surprising to this author, the biggest gap is in the Sector Equity funds, where it averaged 1.5%. These are common used by market-timing stock jockeys. On the other end of the spectrum are the Allocation and Alternative funds; both at 0.1%.

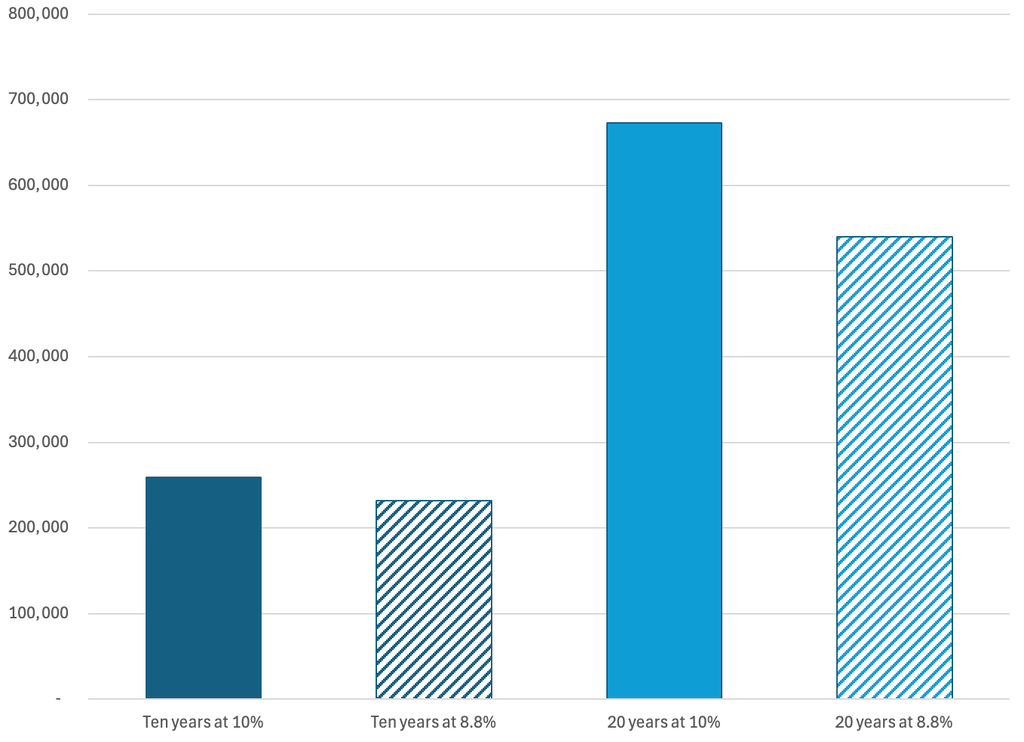

1.2%…as Ted Lasso might say, “big whoop!” Compound that 1.2% over ten years or longer and pretty soon it’s real money–assuming the gap doesn’t revert to its wider levels, as shown below.

Invested over ten years with a 10% return per year, $100,000 grows to $259,000

Earn 1.2% less each year, and $100,000 grows to $232,000, 10.4% less

Invested over 20 years with a 10% return per year, $100,000 grows to $673,000

Earn 1.2% less each year, and $100,000 grows to just $540,000, 19.8% less

This fits well with our investment philosophy of long-term asset allocation along with periodic rebalancing, ignoring noise along the way. In a formula, it’s…

Strategic Allocation + Rebalancing – Noise

We’d love to talk with you about it. You can contact us at info@strategencecapital.com.