Graig Stettner, CFA | Financial Advisor & Partner

Moody’s recent decision to downgrade the U.S. credit rating from Aaa to Aa1 officially ends America’s top-tier debt status across all major rating agencies. This move follows similar actions by Fitch in 2023 and Standard & Poor’s in 2011, reflecting mounting concerns about the nation’s fiscal direction. As Congress navigates budget negotiations that could further expand annual deficits, investors are questioning how these developments might affect their portfolios and long-term financial strategies.

Budget negotiations have historically created periods of uncertainty

Throughout the past fifteen years, budget standoffs and debt ceiling debates have generated considerable market volatility. Notable examples include the 2011 S&P downgrade, the 2013 fiscal cliff, and various government shutdowns. Despite the initial market disruptions, agreements were ultimately reached in each case, allowing markets to stabilize and continue their upward trajectory.

Even following the unprecedented 2011 downgrade that triggered a market correction, the S&P 500 achieved full recovery within months. Remarkably, U.S. Treasury securities continue to function as safe-haven assets during volatile periods, maintaining their role as a cornerstone of global financial markets despite these rating downgrades.

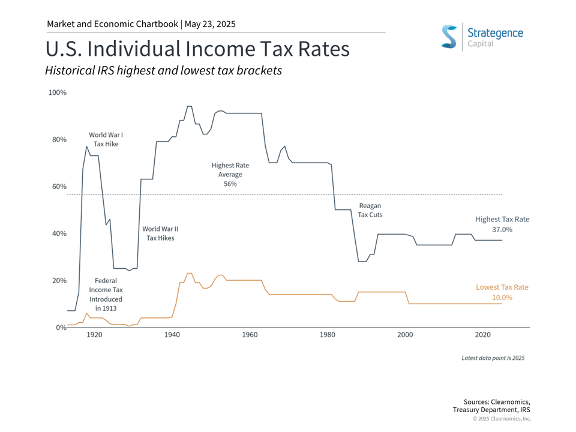

Tax Cuts and Jobs Act provisions are on track to be extended or made permanent

Congress is currently developing a comprehensive budget bill to extend individual tax cuts from the TCJA, which would otherwise expire at the end of 2025. This initiative aims to prevent a potential “tax cliff” scenario where rates would revert to pre-TCJA levels, potentially disrupting economic stability.

The proposed package includes significant provisions for both individuals and businesses. Individual benefits encompass permanent TCJA tax rates with a 37% top rate, an increased child tax credit of $2,500 through 2028, and potential SALT deduction cap adjustments. Business provisions feature an enhanced pass-through deduction of 23%, reinstated 100% bonus depreciation, and restored research and development tax deductions.

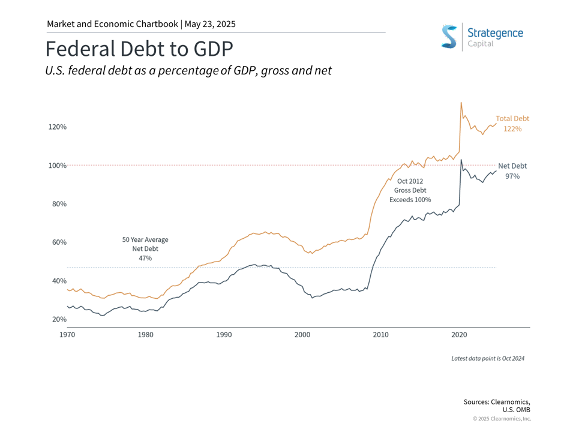

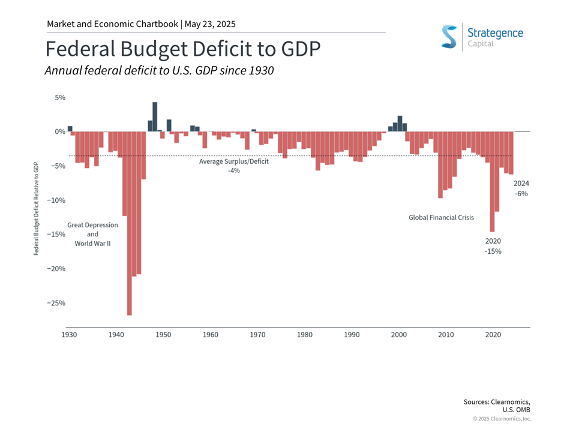

Deficits may continue to add to the debt

While the current proposal incorporates approximately $1.6 trillion in spending reductions through program modifications, these cuts are overshadowed by tax reductions and increased spending in other areas. The national debt already exceeds $36 trillion, representing roughly $106,000 per American, and the proposed budget could add an estimated $3 trillion or more over the next decade.

The persistent growth of national debt reflects the political challenges of reducing spending on mandatory programs like Social Security and Medicare, which consume most federal expenditures. However, markets have historically performed well across varying levels of government debt and deficit spending. Interestingly, some of the strongest market returns over recent decades have occurred following periods of significant deficits, as these often coincided with economic downturns when markets were at their lowest points.

While deficit and debt levels represent important long-term economic considerations, their immediate market impact should be viewed in proper context. A disciplined investment approach focused on diversification, fundamental analysis, and long-term objectives remains more effective than making portfolio decisions based on fiscal headlines or hoping for Congressional deficit solutions.

The bottom line? The U.S. credit rating downgrade reflects legitimate concerns about America’s fiscal trajectory, and current budget negotiations may exacerbate these challenges. However, historical evidence suggests that investors are best served by maintaining their long-term investment strategies and staying committed to their financial plans.

OneAscent Financial Services, LLC (“OAFS”), d/b/a Strategence Capital, is a registered investment adviser with the United States Securities and Exchange Commission. OAFS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by OAFS or any unaffiliated third party. OAFS is neither an attorney nor accountant, and no portion of the presented content should be interpreted as legal, accounting, or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Clearnomics is not affiliated with OneAscent Financial Services, LLC or Strategence Capital.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

No strategy assures success or protects against loss. Investing involves risk including loss of principal.