A common metaphor in our business is the proverbial crystal ball. People will ask, “what does your crystal ball say?” or we might tell someone who asks something like, “well, crystal ball is cracked and not working.”

But what if we or you did have a crystal ball and we knew what was going to happen?

Fantastic, right? Vacation home, here I come!

Or maybe not.

This seems to be an investor’s process:

- Here is an event

- This will be the outcome

Even if we get the event right, we have to get the therefore right, too.

Here’s a case in point (whatever that phrase means) from Bespoke Investment Group, a service to which we subscribe.

Let’s go back in a time machine to January 11, 1963.

On that day, the US Surgeon General issued a report on smoking that was thought to be so damaging to the tobacco industry that he waited until a Saturday when markets were closed to release it to limit the potential stock market chaos. The day after the report was released it was front page top of the fold news in the New York Times with a headline reading “Cigarettes Peril Health” and the sub-headlines “Cancer Link Cited” and “Smoking Is Also Found Important Cause of Bronchitis”. Besides the front-page headlines, the Sunday edition was rife with stories on the ‘revelation’ that smoking wasn’t good for you.

As much as the tobacco companies tried for decades to convince consumers otherwise, anyone with a minimal amount of intelligence who had ever smoked a cigarette probably already knew that it wasn’t something you did in order to get yourself into shape or good health. As far back as the 1940s, scientists had already made the link between smoking and lung cancer. Smoking was considered a vice for a reason! Even as many (or most) Americans already knew of the dangers of smoking, an official statement from the Federal government was a big deal, though, and would pave the way for more regulation of the sector. If you owned tobacco stocks heading into that weekend, you probably weren’t looking forward to Monday’s opening bell.

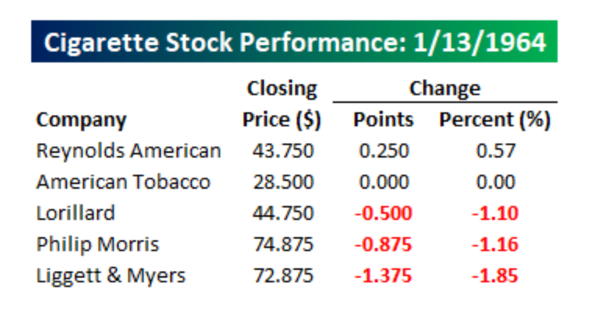

https://www.bespokepremium.com/interactive/

When the bell rang Monday morning, tobacco stocks opened lower, but by the end of the trading day, their performance was a surprise to most. Of the five major tobacco companies at the time, Reynolds American actually finished the day higher, and American Tobacco was unchanged on the day. Of the remaining three major tobacco stocks, none of them even finished the day down 2%. Perhaps the most amusing aspect of the New York Times market recap the following morning was that cigar stocks traded higher on the day as “cigar smoking received a relatively clean bill of health”. It looks like at least one part of the industry had effective lobbyists!

The performance of the cigarette stocks on the first trading day after the Federal Government first officially recognized the dangers of smoking illustrates once again how the market can defy consensus expectations. While the Surgeon General’s report on the dangers of smoking should have been a blow to cigarette stocks, the initial reaction to the report was muted. When everyone is zigging, the market often zags.

I continue to insist that one of the key factors to investor success is humility.

First, recognize that you know very little about the future, other than it is uncertain. Second, recognize that you don’t how a future event will produce a certain outcome. Instead, create a sound investment plan and stick to it.