The start of 2022 has been rocky, to say the least.

Recently, the Standard & Poor’s 500 (S&P 500) had declined 13.9% from the January peak 1. Stocks are not the only asset class getting beated down. Year to date, through April, core bond funds were down 9.5%, which, if the year ended in April, would be the worst year ever for core bonds (previous worst was –2.9% in 1994) 2. Pair all of this with a swelling inflation rate of 8.5 (Consumer Price Index; March 2022), and an investor can’t be blamed for wondering what to do.

It may be a good time to make lemonade out of lemons by considering a Roth conversion.

Huh?

Roth conversions are when an individual takes a portion of a retirement account that has not yet been taxed (I.e., traditional IRAs) and moves it to a retirement account that is post tax (I.e., Roth IRA). Some qualified retirement plans, such as a 401(k), may allow this, too.

Here are reasons why I believe that Roth conversions can make sense right now:

- The stock market is on sale. When I go to the store, and I see a special sale on that exact thing I’m looking for, why would I wait for that item to go back up in price before I buy it? When completing a conversion to Roth when the market is down, you get to swap out your investments at a lower tax basis. I’ll provide an example later in this article.

- Taxes are on sale.3 We are experiencing an extremely favorable tax environment right now. With the Tax Cuts and Jobs Act that is set to expire in 2026, this is could be a good time to realize income.

- There are no required minimum distributions in Roth IRAs. That is not the case for traditional IRAs. Every year, starting at age 72, investors are forced to take money out of their IRAs, no matter if they need the money or not.

Let’s look at an example to give you a better understanding of a Roth conversion. If an Indiana resident (home state bias on display, here) in the 22% federal tax bracket, and with a state tax rate of 3% (rounded down), converts $50,000 of a traditional IRA to a Roth IRA, their taxable income for the year will increase by $50,000. Assuming they stay in the same 22% bracket* with the $50,000 of additional income from the conversion, the tax liability is approximately $12,500 in federal and state taxes at the time of conversion. Hopefully you are tracking with me so far. The next part of the Roth conversion scenario is where investors can really benefit from this strategy.

It’s important to consider one’s tax bracket. A jump from the 22% tax bracket to the 24% tax bracket, the next one, isn’t a big one, but jumps from the 12% and 24% brackets are big moves.

If a market correction reduces the investment account by 15% and the Roth conversion is completed at $42,500 in value, the federal income tax liability from the conversion would fall to $10,625 yielding a $1,875 tax savings upfront. The caveat is once the funds are held inside a Roth IRA, any future market rebound and appreciation will be free of tax 4. The S&P 500 has never not rebounded over some time frame.

Other Considerations

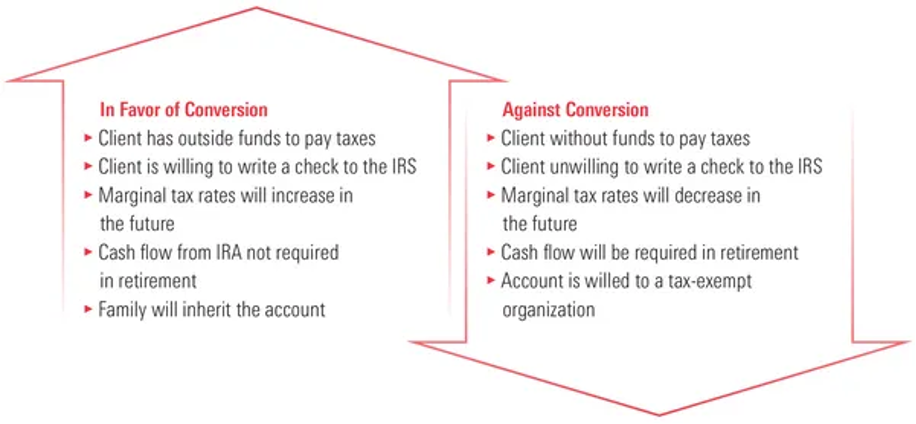

The decision to convert all or a portion of your pre-tax IRA accounts depends upon an individual’s own facts and circumstances. Taxpayers are advised to speak with their tax and financial advisers prior to undertaking a Roth conversion. Some of the additional considerations include:

Sources:

1. LPL Research

2. LPL Research

3. “Low Tax Rates and What to Do” , Strategence Capital Blog

4. “Everyone is Talking about Roth IRA Conversions and Here’s Why” , Kiplinger

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.