Taking Required Minimum Distributions? Charitably Inclined? Consider a QCD

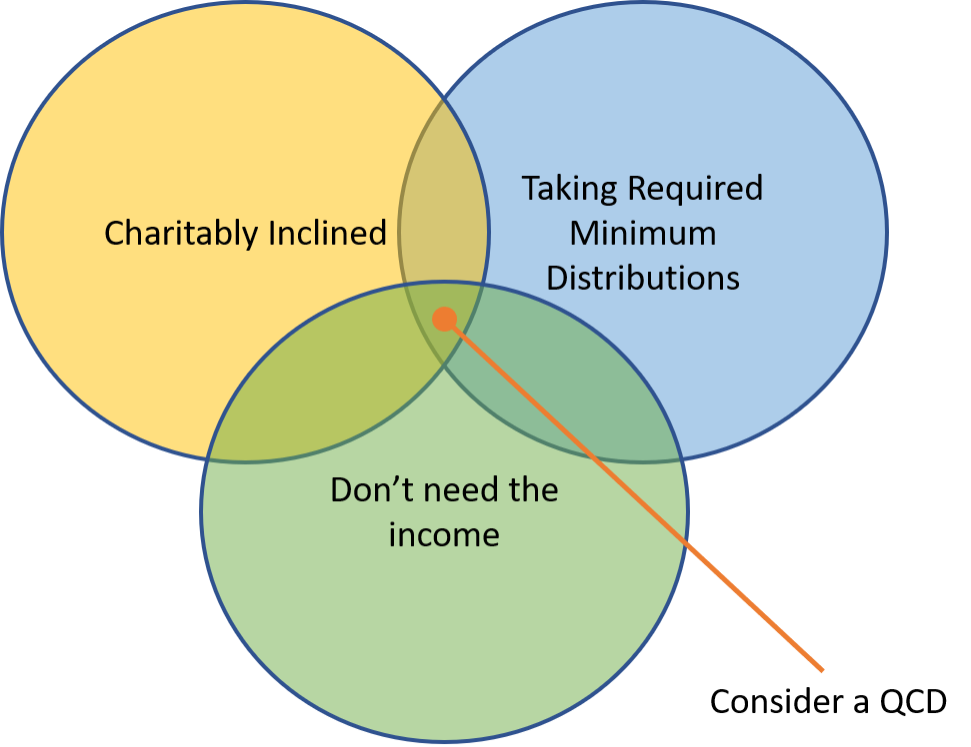

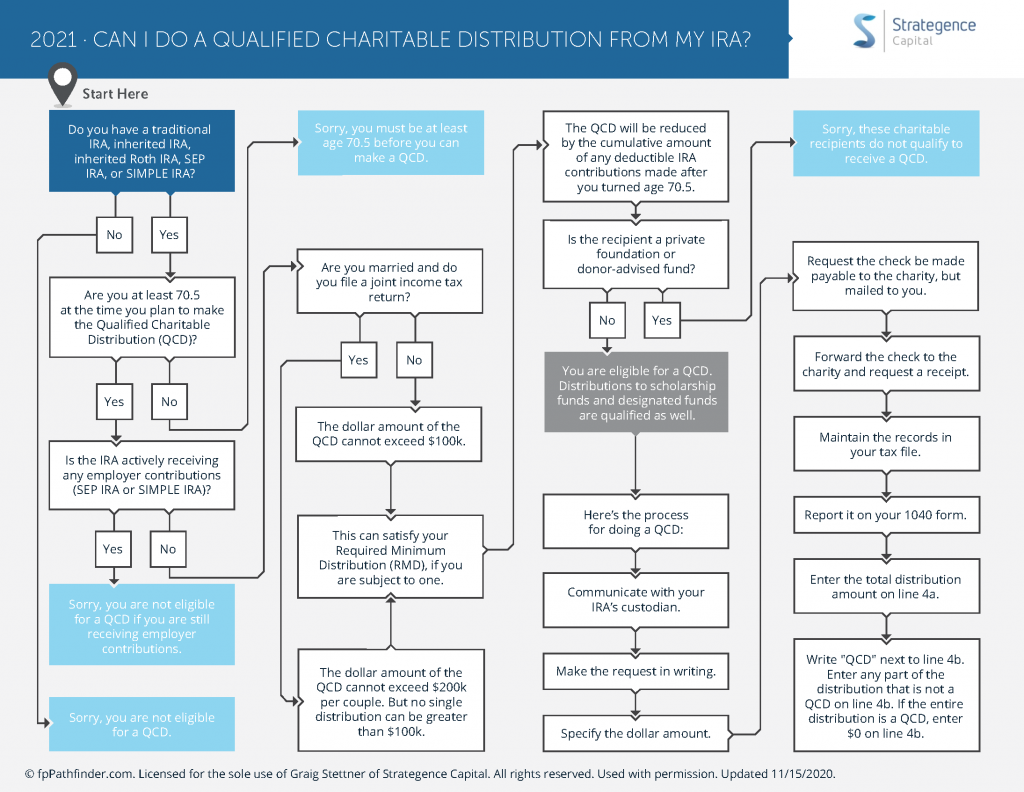

A QCD is a qualified charitable distribution. It’s a basically an otherwise taxable distribution from an IRA that is paid directly to a qualified charity. Importantly, it can be used to satisfy your required minimum distribution if you’re required to take them and don’t need the income.

You will need to talk to your tax professional, but if the Venn diagram describes you, consider making a QCD. In addition, we have included below a flowchart to help you determine if a QCD might make sense for you. Additional resources:

Additional resources:

https://www.fidelity.com/building-savings/learn-about-iras/required-minimum-distributions/qcds

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-distributions-withdrawals

This information is not intended to be a substitute for specific individualized tax advice. LPL Financial does not provide tax advice.