This may be one of the best financial planning tools that we at Strategence Capital can’t use. That’s because we don’t offer a high deductible health plan, which is what one needs to set up an HSA.

An HSA is a tool that should be investigated to see if it fits with your situation, primarily for this reason: it’s tax deferred in all three phases.

- That is, contributions are before taxes are taken out; it’s a pre-tax contribution.

- The accumulation or growth phase is tax deferred; and

- The distribution phase is tax free if the distributions are qualified. Specifically, distributions have to be for Qualified Medical Expenses.

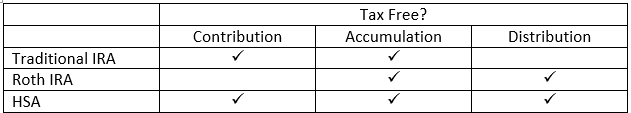

Other tax-deferred vehicles, such as 401(k)s, Traditional, or Roth IRAs are only tax deferred in two of the three phases above. All offer tax-deferred growth, but the Roth option involves a taxable contribution, while a Traditional IRA involves a taxable distribution. A 401(k) is an employer-sponsored retirement plan that has elements of both IRA types.

You might say that you’re already using the HSA that your employer offers. It’s great! Put money in, and you can take it out tax free to pay for medical expenses.

The strategy we propose here is different. You put money in but don’t use it for medical expenses. Instead, you pay those expenses through normal cash flow; i.e. other funds. But keep those receipts…forever. We’d recommend saving them in electronic form, by scanning them. If you lose your receipts and cannot substantiate that the withdrawals were for medically qualified expenses, you will pay taxes on the distribution and if taken before age 65, a 20% penalty will also be incurred.

A High-Deductible Health Plan, which you are required to have to qualify for an HSA, can put a greater financial burden on you than other types of health insurance. Even though you will pay less in premiums each month it could be difficult–even with money in an HSA–to come up with the cash to meet the deductible for a costly medical procedure. This is something to consider for anyone who knows they will have hefty medical bills in a particular plan year.

You see, the IRS says that medical expenses incurred after an HSA was set up can be reimbursed anytime. There is no shelf life for qualified medical expenses (there’s a link to a list of these at the bottom of this blog post.) That means that expenses you incurred and paid for chiropractic treatments in your 50s can be reimbursed in your 70s to pay for your vacation. But, wait, aren’t HSA distributions limited to qualified medical expenses? Yes, and that’s why you saved all those receipts from the chiropractor visits.

Some HSAs charge a monthly maintenance fee or a per-transaction fee, which varies by institution. While typically these are not very high, the fees are almost certainly higher than any interest the account may earn and do cut into your bottom line of returns you may earn on an investment. Sometimes these fees are waived if you maintain a certain minimum balance.

Meanwhile, the $1,000 you spent on chiropractor visits at age 50 grew to $2,654 by age 70, assuming an investment return of 5% per year. “Investment return?” Right. A key to this is investing the funds in the HSA so you can get the benefit of tax-free growth. Most HSAs allow funds over a certain amount—maybe $1,000–to be invested in various investment products.

There’s another planning opportunity in this article: https://www.nerdwallet.com/article/finance/how-to-harness-your-hsas-superpowers, but I was too annoyed by the fact that we don’t have an HSA, that I didn’t describe it.

Qualified Medical Expenses

https://www.irs.gov/pub/irs-pdf/p502.pdf

This information is not intended to be a substitute for individualized tax advice. Please consult your tax advisor regarding your specific situation.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.