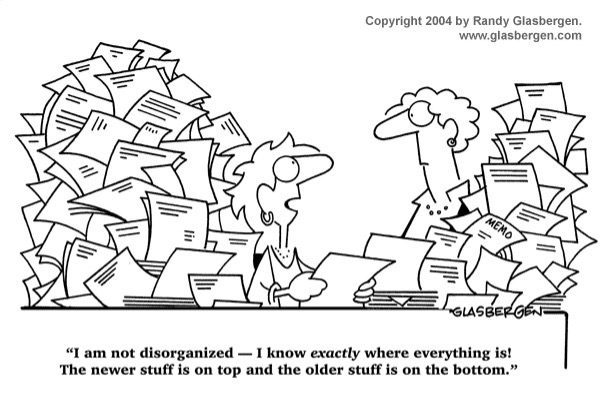

If you are like me, you have a filing cabinet that continues pile up with files from previous years tax returns, bills, estate planning documents, receipts, the list goes on. I’ve by no means mastered the art of organization, as I am constantly asking my wife if she has seen my wallet and keys.

I recently came across a Wall Street Journal article (“How to Get Your Files in Order” March 3, 2021) that provided a few helpful tips from organizational experts (who knew that was a career), on what you should keep, scan, or shred. A synopsis of that article is below:

Financial Records

This may come to a surprise, but the IRS only recommends keeping copies of your tax returns and related documents for three years. That’s it. It’s okay to shred those returns of the years when you made $4.25 an hour sweeping floors.

When you make home improvements to your residence or a rental, be sure to keep those records for when you sell the property so you can accurately determine your cost basis. Unless you are feeling extra patriotic, there is no need in paying the tax man more than what you legally owe.

Bills & Receipts

Speaking of selling your home, did you know that home buyers can request up to a year of the seller’s utility bills? The article suggested keeping at least a year’s worth of utility bills in a cloud-based database.

It also was suggested to keep record of your car’s maintenance records. I know when I go to buy a vehicle, I always appreciate the seller providing those records. Right or wrong, I get the assumption that the seller took good care of the vehicle if there are service records.

Although the article did not touch on this, I would also suggest keeping records of your medical bills throughout the year. If you have a high-deductible insurance plan, you are eligible to contribute to a health savings account (HSA). HSAs are wonderful savings vehicles, and it’s possible the funds can be invested. The money that goes into an HSA is tax deductible; grows tax free; and if used for medical purposes, can be taken out tax and penalty free; essentially, HSAs are triple tax free.

Vital and Legal Records

The experts interviewed by the author recommend keeping all original documents on legal and vitals for perpetuity. This list includes birth records, marriage licenses, death certificates, adoption papers, military service records, deeds, titles, Social Security cards, and professional licenses. Keeping copies of physical and electronic versions was recommended; if stored online, be sure they are secure.

Estate Planning

According to the article, “the only document that absolutely has to be a physical copy from an estate planning perspective is a person’s will.” An individual’s last will and testament is considered revoked if the original is burned or torn up.

It is a good idea to communicate to your loved ones and the future executor of your estate where the will is kept, along with any other estate planning documents. If you have Power of Attorney documents in place for health care decisions, it is advisable to provide an electronic version to your decision maker in case of accident for ease of access.

Summary

If you plan on taking the task of getting your files in order, there are some digital tools that can help. Cloud storage that you may already have access to would include Google Drive, Apple iCloud, or Microsoft OneDrive. Here at Strategence, some of our clients use our digital vault that we make available to upload and access important documents. Another helpful tool that I use is a PDF scanner app. This app allows me to take pictures that can be scanned and uploaded directly to the cloud.

The opinions voiced in this article are for general information only and should not be considered an individualized recommendation or personalized investment advice.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.