The problem

A recent survey by MassMutual, a life insurance company, and Age Friendly Advisor found that 40% of retirees receiving Social Security wish they had waited to file for benefits until later. That’s because every year one delays up to age 70 the benefits incrase, and retirees may leave money on the table, depending on when they file for benefits.

Importantly, 60% of those surveyed got no advice on when to file, and “only 8% filed as the result of consulting with a financial advisor.”

Possible solutions

We have some powerful tools that can help you make the right decision if you haven’t yet filed to receive benefits. Even if you have already claimed your benefits and want to change your mind, you may have options.

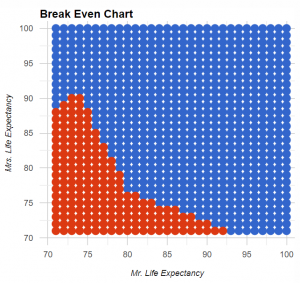

A common way of looking at claiming benefits is by calculating one’s “breakeven” age, the age one must life to before the increased (delayed) benefits exceed the earlier-claimed benefits. So, one might calculate a breakeven age of 84, and decide to take benefits earlier because of a family history of poor health.

While this is one way to look at it for a single person, a married person must also consider the age of his or her spouse, and that complicates the breakeven concept, as there is a range of age combinations…and spousal benefits come into play.

Our tools take all of that into consideration and produce a matrix of age combinations that look like the chart above, where the wife’s life expectancy is on the vertical axis, the husband’s on the horizontal.

From that and more, the earliest claiming strategy is compared to other scenarios to consider lifetime benefits and arrive at a hopefully optimal claiming strategy. We would be happy to perform this analysis for you, we just need copies of Social Security benefit statements for both you and your spouse, which you may access at this link.