We’ve received a lot of emails and phone calls from folks concerned about the election and its impact on investment markets. Before you read further, understand that this post is not a political statement, and is not intended to promote one political party. Anything that comes off that way is purely accidental.

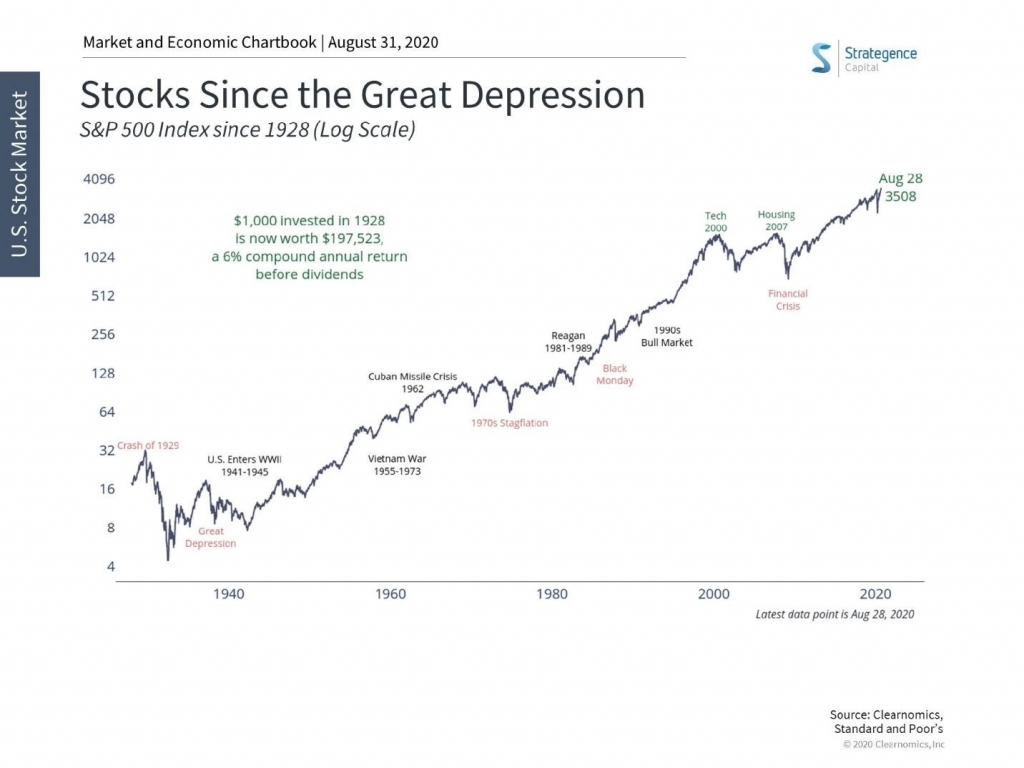

The image below shows the long-term path of the stock market. It covers a lot of political administrations, and yet the long-term direction is up and to the right.

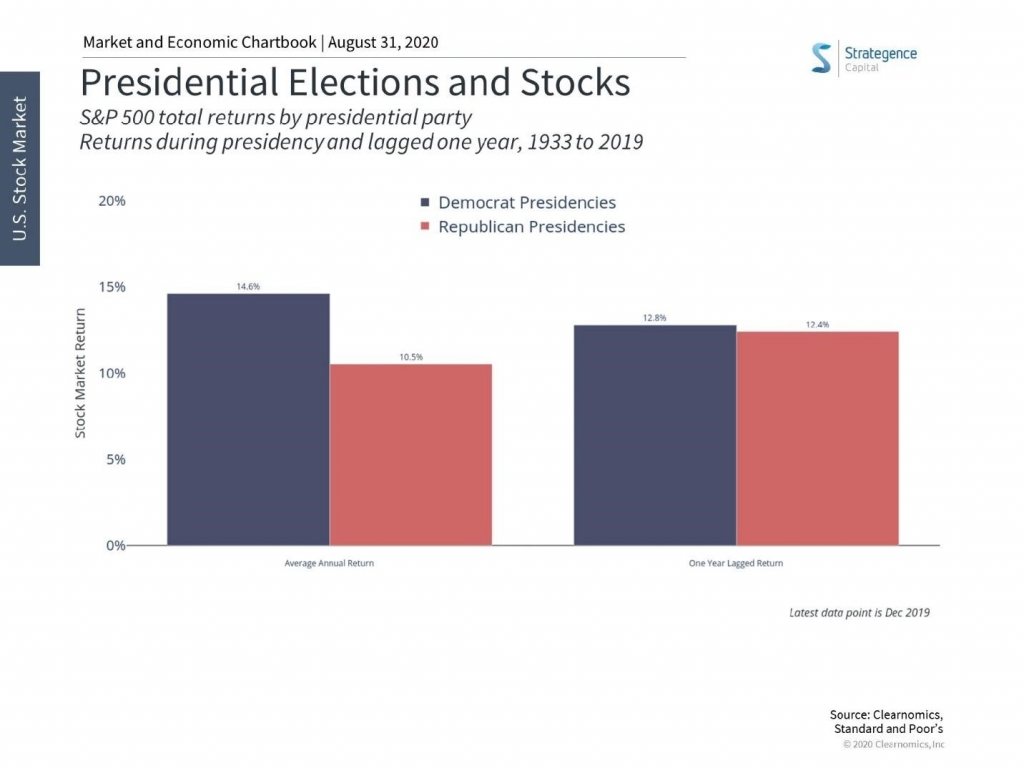

Given the polarization in the U.S., I’m guessing you are pretty sure that if the other political party gets in office, that the U.S. economy and stock market are going to go off the rails. Here is a clinical look at returns by political party, and by lagging the returns by one year (right pair of bars), we can model the lagged effect of policies. If you squint, you can see that returns do modestly better during democratic administrations. To be fair to statisticians, it is a small sample size.

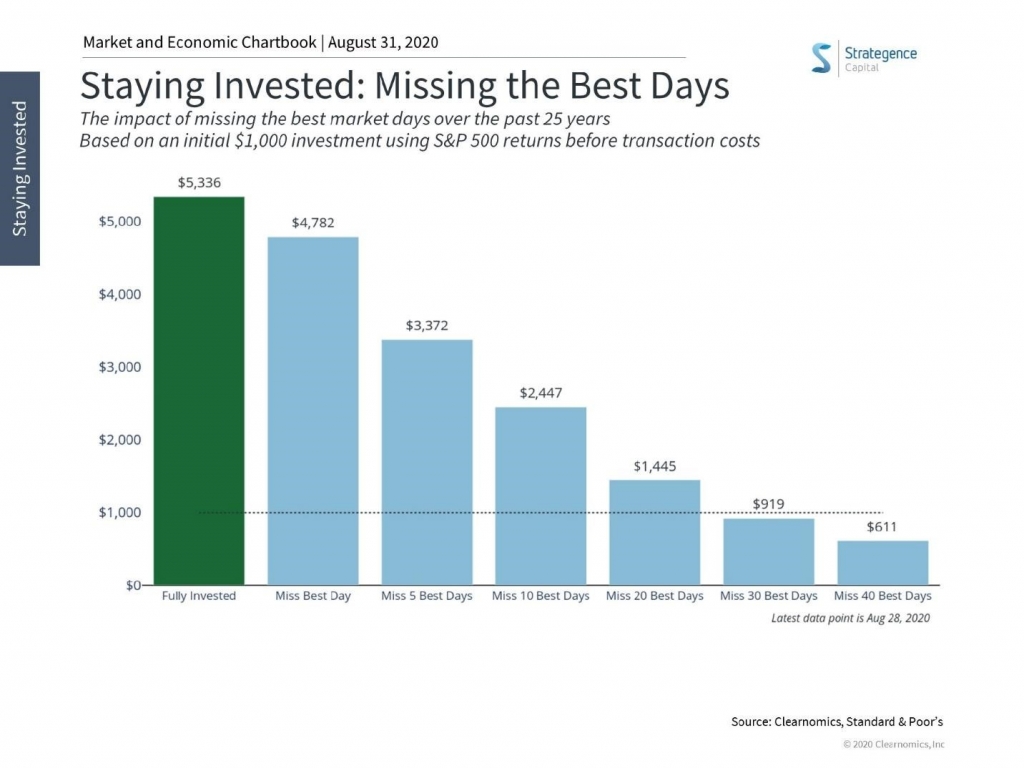

We strongly discourage what some call derisively “market timing,” and what others call “risk management.” Regardless, if you’re out of the market, and miss just one day, your long-term returns can be dramatically impacted.

Allow me to speak frankly for a moment—and maybe offend you

There are millions of what smart people call market participants. They include hedge funds, Robinhood investor/speculators, 401(k) participants, mutual funds, sovereign wealth funds, value investors, growth investors, and more. Most of them are interested in the same thing as you, seeing their investments go up in value. To varying degrees, each is employing all their mental faculties and literally employing others to research companies, consider policies, determine economic impacts, and forecast thousands of data points. They have done and continue to do that. They, too, know there’s an election in November.

And, yet the Standard & Poor’s 500 index is at an all-time high.

You must ask yourself: what do I know that they don’t?

Maybe more importantly, what do they know that you don’t?

Other things you could ask yourself:

- What if I’m wrong?

- When will I get back in, especially if I’m wrong?

- Since when is the gut a thinking organ?

- How did it work out the last time I had a hunch like this? How about the time before that?

- From 0 – 100, how confident are you that your conclusion is right?

- If I sell, what does the party who buys my stocks from me know that I don’t? For every seller there is a buyer.

None of this is to say that there will not be volatility related to election headlines or outcomes. What it does try to say is that you can’t predict accurately what will happen to investments. Still, let’s look at some actions that you can take and that we would generally be supportive of.

- Check your risk tolerance versus your investments. You should always hold a mix of investments that is appropriate for your risk tolerance. If you’re nervous about the election, this would be a good time to review your risk tolerance. We can help. You can click here to do that now.

- If you absolutely must do something, take half measures in the event you’re wrong. For example, if your original thinking was to get out of all stock investments and sit in cash, how about selling no more than half?

- Want to hear from someone smarter than us? Check out the video here.

If history is a guide, what you do probably matters more than the election. Benjamin Graham is one of the great fathers of investing. He said, “the investor’s chief problem—and his worst enemy—is likely to be himself. In the end, how your investments behave is much less important than how you behave.”

In the meantime, operators are standing by.