If you spend any amount of time in the world of finances reading, listening, or otherwise paying attention, you will likely encounter words and phrases that do not crop up in mainstream vocabulary. In an effort to improve clarity and transparency, we hope to explore some of these terms in upcoming posts.

A phrase that gets used often with the Wall Street set is “priced in.” It stems from the efficient markets hypothesis, which says that all publicly-available knowledge is already reflected in stock prices, and that only non-public information is not reflected. To say something is priced in means that the something is already reflected in stock prices.

So, for example, on December 31, 1999, the fear of a Y2K disaster was already priced-in to stocks.

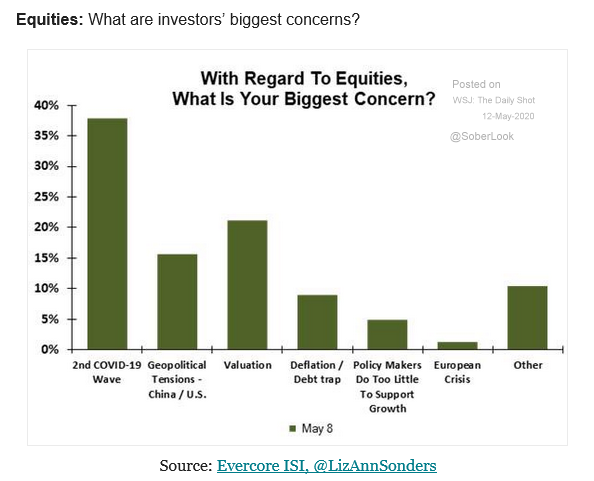

Here’s a current example that was featured in the Wall Street Journal’s “Daily Shot” publication.

So, to some degree, stocks are pricing in a risk of a second wave of the Coronavirus. In fact, it’s the biggest fear of investors in this survey. In this case, other fears are being reflected in security prices, too.

While all of that may be knowable, what is unknowable is the extent of a second wave that’s priced in.