It’s pretty much inevitable that when markets become volatile, some clients will want to sit things out for a while by selling the investments that are causing the most pain. They usually say something about getting back in when things look better; the poetic might say something like “after the storm has passed.” Some might think they will buy back in after the market declines further—you know, sell high, buy low. There are a couple of problems with these strategies.

First, the second strategy almost by definition requires one to get back in when the news is worse, after all, that’s what made the prices lower. I think they imagine it playing out how I’ve described in my artwork to the right. But the news at the bottom is always dreadful.

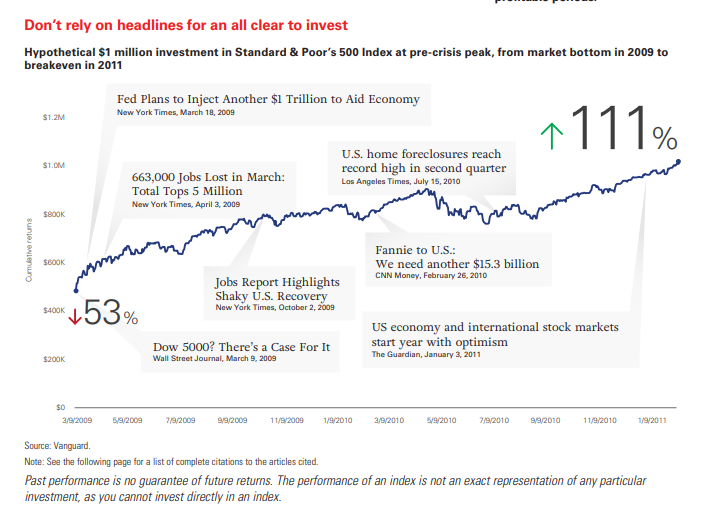

The investor who decides to wait until the news starts to reflect better news will likely have to wait a long time, at which point, prices will have already risen to reflect the good news, as can be seen in the chart below from Vanguard. You can see the full-blown piece here.

We think the best approach is to choose an asset allocation likely to help you reach your financial goals and stick to it, rebalancing only as necessary.

If you’re looking for more advice as we navigate this current environment, check out this recent post. As always, we are available to field your questions and concerns.