After enduring the 2008-2009 Great Recession, when the global economy was brought to its knees (due to enrichment schemes by Wall Street and its brokers), we thought we’d seen the worst market in our lifetimes. Some of us thought the same thing during the Tech Wreck at the start of the century. We were wrong. Today, we take a look at where we are now and try to recap since COVID-19 touched down here and changed life as we know it.

Last week confirmed that we’re now traveling together through the third once-in-a-century market event in the 21st century’s first two decades. On Monday the Standard & Poor’s 500 index tumbled 12%, breaking through the now-familiar stock exchange circuit breakers. Traders have, for a long time, called Tuesdays Turnaround Tuesday, and last Tuesday, March 17, brought a ray of hope as the index gained 6%. In any other market environment, this would be considered a remarkable one-day gain.

Then the roof caved in again.

Wednesday saw the S&P 500 drop 5.18%, followed by a small 0.47% gain, and then, on Friday, another 4.34% loss. Just a month ago, the index was recording all-time highs. Now we have experienced two of the worst market weeks since 2008. And this week didn’t start on a positive note.

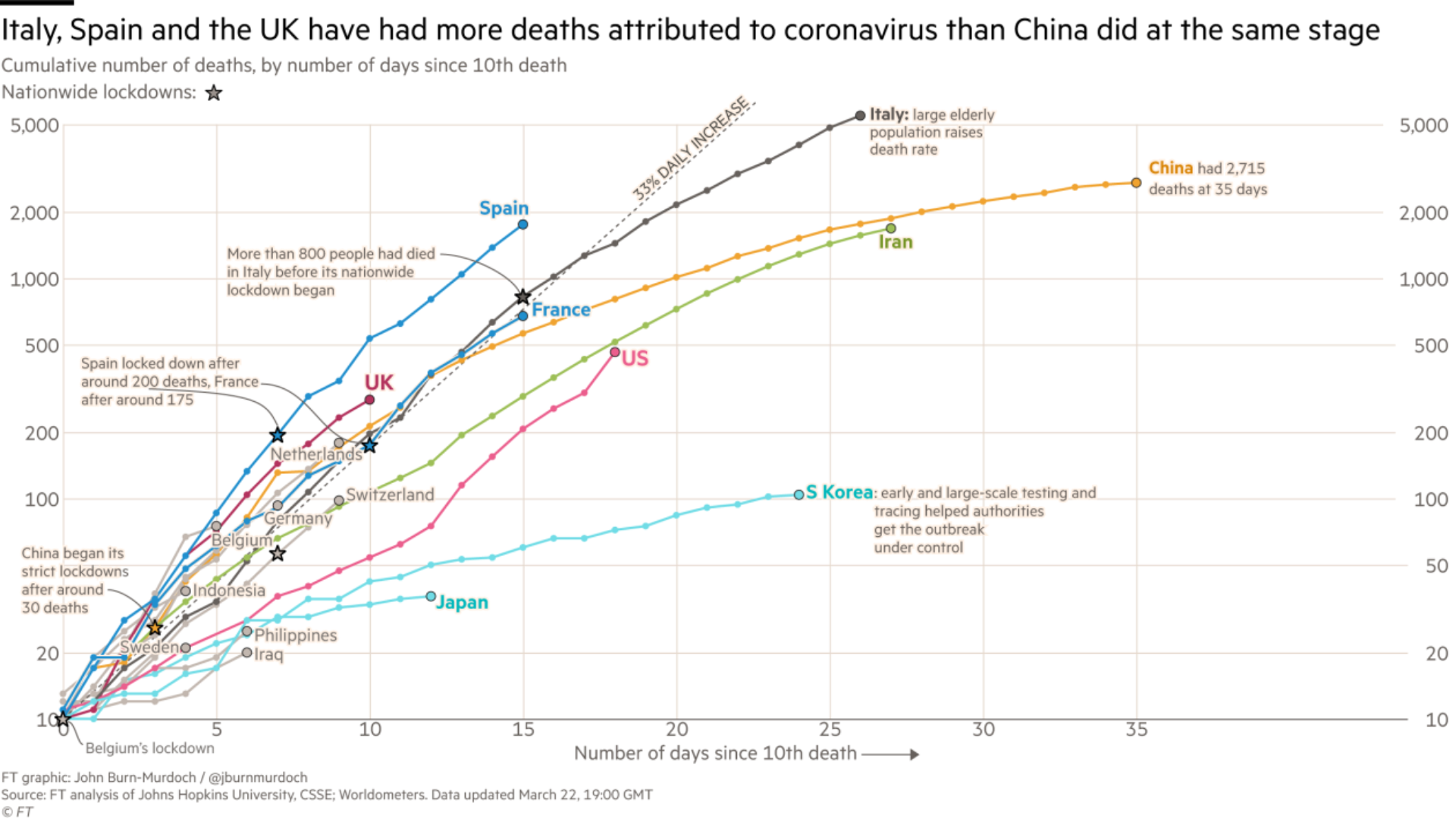

The reason that traders are running for the exits is, of course, the unpredictable course of the COVID-19 crisis. You don’t have to be told how our social distancing lockdown is disrupting economic activity. This is almost certainly the first time anyone in the X, Y, Z and Baby Boom generations has seen empty grocery aisles (flour, anyone?), shuttered restaurants and theaters, and empty corporate offices as people in all walks of life are told to work from home. You can see the progress of the virus in various countries in the chart below.

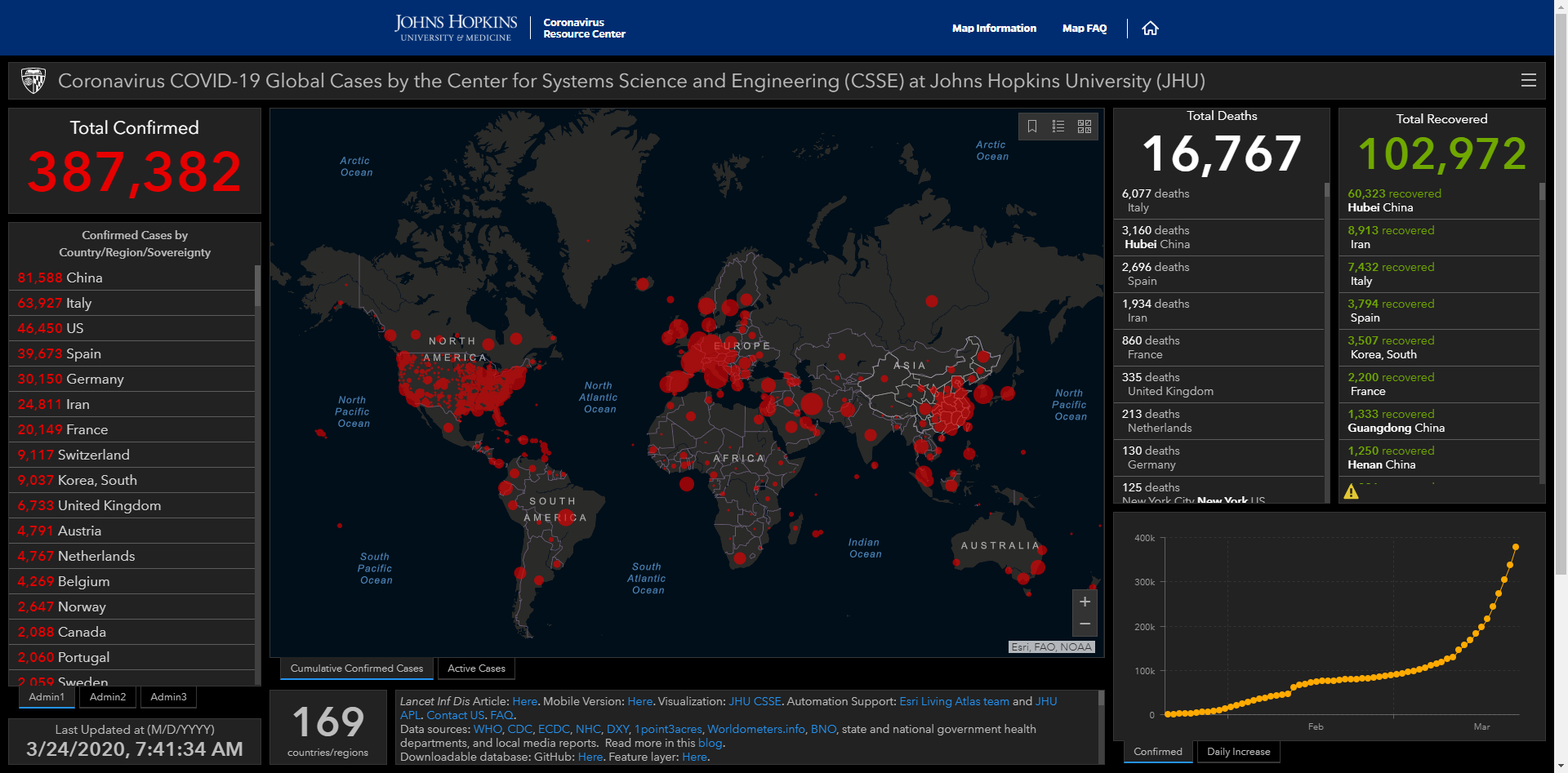

You can view the real time movements of the disease in various dimensions on the fascinating Johns Hopkins and Medicine Coronavirus Resource Center website. There’s even a case in Greenland. (Do people even live there, where the country’s name is a marketing scheme?)

The bottom line is that the number of cases is still increasing dramatically, despite a near-lockdown of our society. What I haven’t seen reported in many places is the number of recoveries (100,885 as of yesterday; higher when you read this), which the Johns Hopkins site shows prominently on its homepage. It’s a little bit of good news that gets neglected in reporting how bad things are.

The federal government has not been completely inactive during the crisis.

You already know that the Federal Reserve Board has dropped its rates to near zero in order to make it easier for banks to lend money to corporations. More recently the Fed has pledged to reinstate its Quantitative Easing program, which means (for now) buying at least $500 billion of Treasury bonds and $200 billion of mortgage-backed securities. This can be seen as an attempt to drive down interest rates and inject liquidity into the financial system. The Fed has said that, in essence, it will do whatever it takes. That’s the monetary policy side.

Since monetary policy is often like pushing on a string (do I really need a new loan?), what we’re waiting for now is fiscal policy, the government spending side of things. This could include policies like sending checks to every household or it could include programs that might strengthen our nation for the future, like a massive health care project. As of this writing, Congress is working on something that both sides of the aisle can agree on.

Meanwhile, the Internal Revenue Service has scrambled to provide relief of its own, extending the date that people have to file their tax returns from April 15 to July 15. The deadline for making contributions to an IRA, Roth IRA and Health Savings Account have also been extended to July 15, but right now nobody seems to know whether people filing for an extension will have to file six months from April 15 or July 15.

Another area of confusion: people who are required to make quarterly estimated payments have seen their April 15 due date extended to July 15, but the second quarter estimated payment is still, as of this this writing, due on June 15.

Are there any strategies to deal with situations like this?

If you have a year’s worth of your expenses set aside in cash, then you have the means to simply live out the downturn without locking in the losses the market has already delivered or new ones that may arise when the second quarter GDP numbers come in negative and the economists declare a recession.

While the cause is always different, in the past, markets have always recovered and gone on to new highs. Moreover, companies are almost certainly not 30% less valuable today than they were in January, no matter what the market valuations are trying to tell us. If you must get out of investments, please, please, please, have a plan to get back in. To paraphrase Hans and Franz, from Saturday Night Live, “listen to me now; hear me later.”

The only time it will feel good enough to get back in is after markets have risen. You will miss out on part of the recovery.

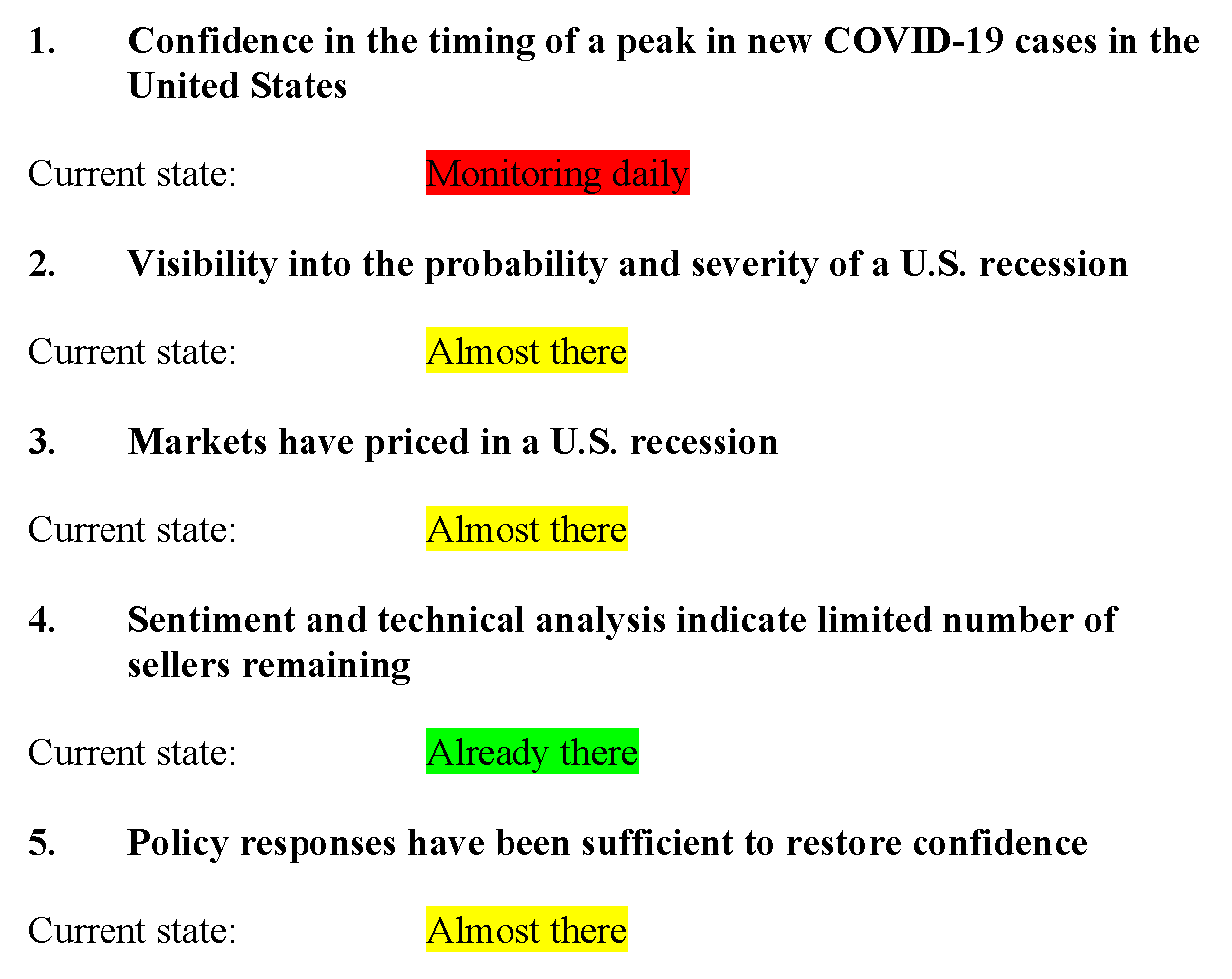

LPL Financial, our broker-dealer, recently put out its “Road to Recovery Playbook,” which laid out some signals that might indicate the market is done declining. They are listed to the left, along with their current status.

More importantly, self-quarantining, working from home, avoiding physical contact with others and social distancing are clearly the best strategies to mitigate this epidemic, even if they are sometimes challenging. Remember that something more important than money is at stake here: peoples’ lives, and the hospital system’s operational capacity.

Just as important is keeping your sanity.

Hard as it might be in these incredibly stressful times, recognize that, just like the plagues that ravaged the world in days of old, this one will pass. Our hope is that you will take time to walk outside—with an appropriate distance from others—and look for ways to find joy every day.

Someday, it will be a remarkable story to tell your children or grandchildren, who will marvel at how tough we were that we could move ahead with our lives in difficult circumstances. Please accept our prayers, best wishes, and help if and when you need it.