One problem with recessions is that they’re best viewed in the rear view mirror, which is to say that it’s very difficult to know when a recession has started.

After some time, when employment is plunging, the manufacturing sector is in a funk, and consumer spending is declining, it’s easy to say we’re in a recession. There have been several occasions, however, when smart people have made proclamations about there being no recession in sight, when, at the time, the economy was already in recession.

Technically speaking, we define a recession as two consecutive quarters of economic contraction. That means that an economy can decline for six months before a recession is declared. And, so, one pursuit of economists is looking for an indicator that, in nearly real time, can indicate whether an economy is in recession. For example, the GDPNow indicator uses high-frequency economic data (it comes out at a relatively high frequency; monthly rather than quarterly, etc.) to forecast GDP growth by “synthesizing the bridge equation approach relating GDP subcomponents to monthly source data with factor model and Bayesian vector autoregression approaches.” Right, just what I would have used.

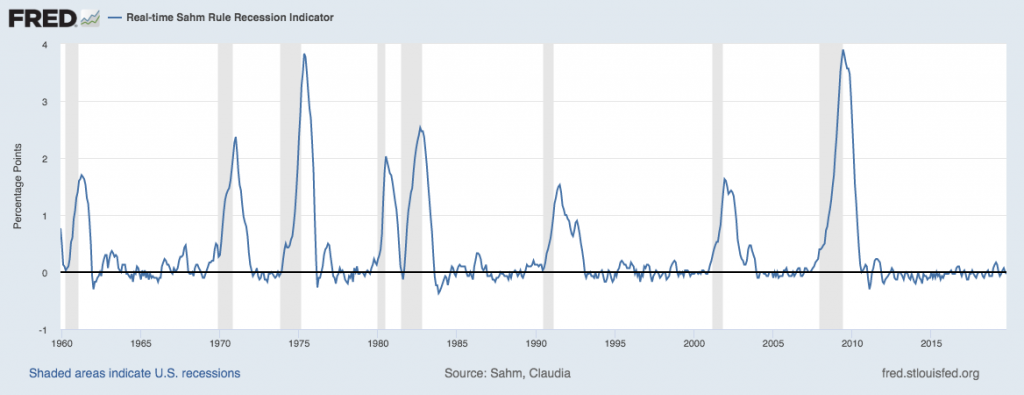

The latest economic indicator to make a splash is the Sahm indicator, named for economist Claudia Sahm, a Federal Reserve economist.

Sahm discovered it by nerding out over unemployment. The Wall Street Journal reports that:

“The unemployment rate has risen sharply in every recession, and thus economists have long looked for recession signals in its behavior. Ms. Sahm spent weekends playing with a massive spreadsheet, testing different rates of increase over varying periods of time, to arrive at the following formula: If the average of unemployment rate over three months rises a half-percentage point or more above its low over the previous year, the economy is in a recession.”

Furthermore,

“Her formula would have accurately called every recession since 1970 within two to four months of when it started, with no false positives, which could trigger unnecessary and costly fiscal stimulus.”

Sahm has probably forgotten more about economics than I’ve ever known, but ours is a dynamic economy, and what once worked may not always work. The Philips Curve and the Taylor Rule are examples of these. What’s more, with just 11 recessions over the last 70 years, the sample size is quite small.

For now, you can add the Sahm Rule to the list of indicators saying that the economy is doing just fine. (The current reading is –0.3%, far from the +0.50% recession-indicating threshold).