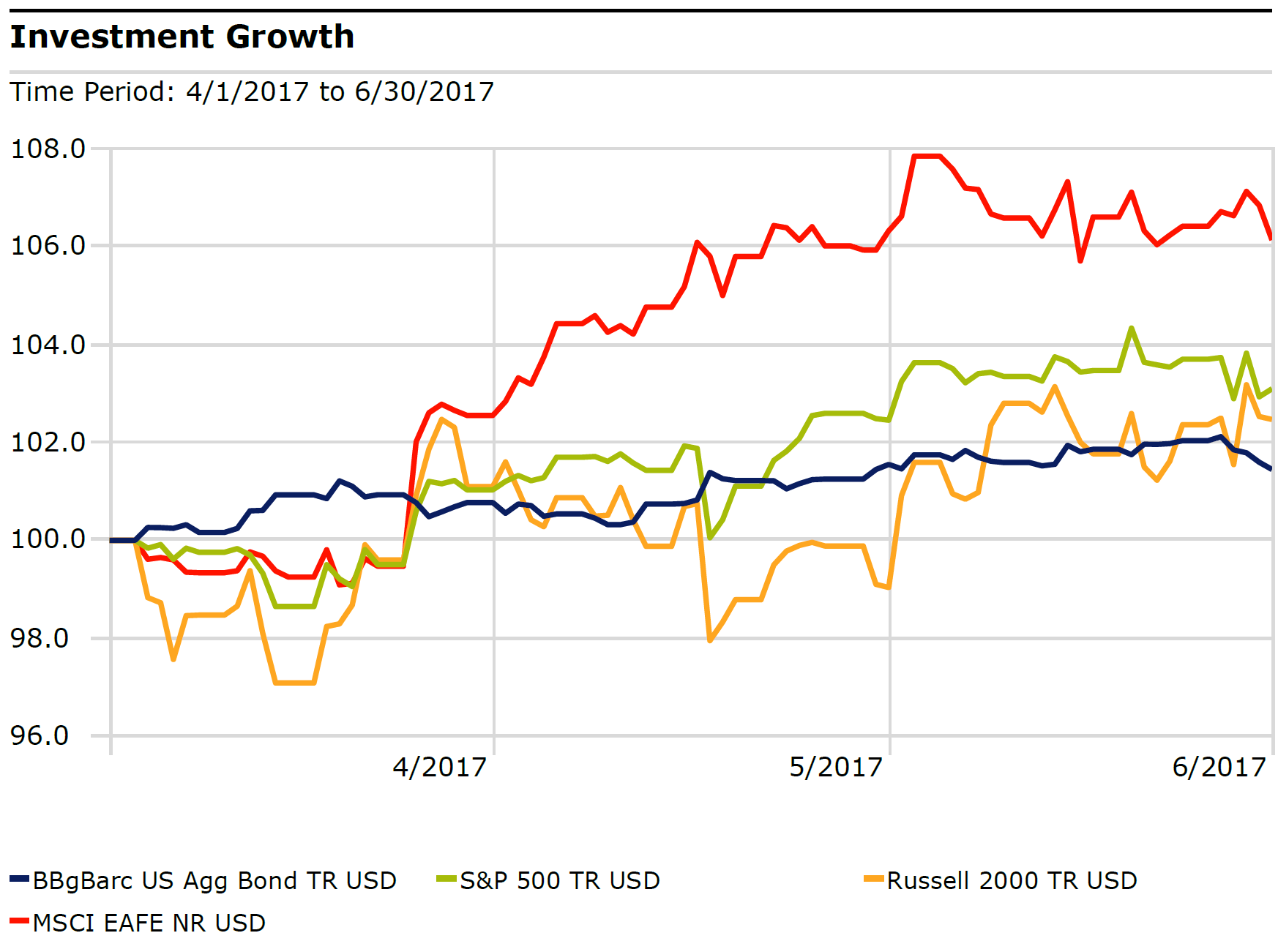

Foreign stocks, as measured by the Morgan Stanley Capital International Europe Australasia and Far East index—EAFE—pronounced ee’-fuh by those in the business, continued to lead the way in the second quarter, making that asset class the best performing asset class of those shown here.

click to enlarge

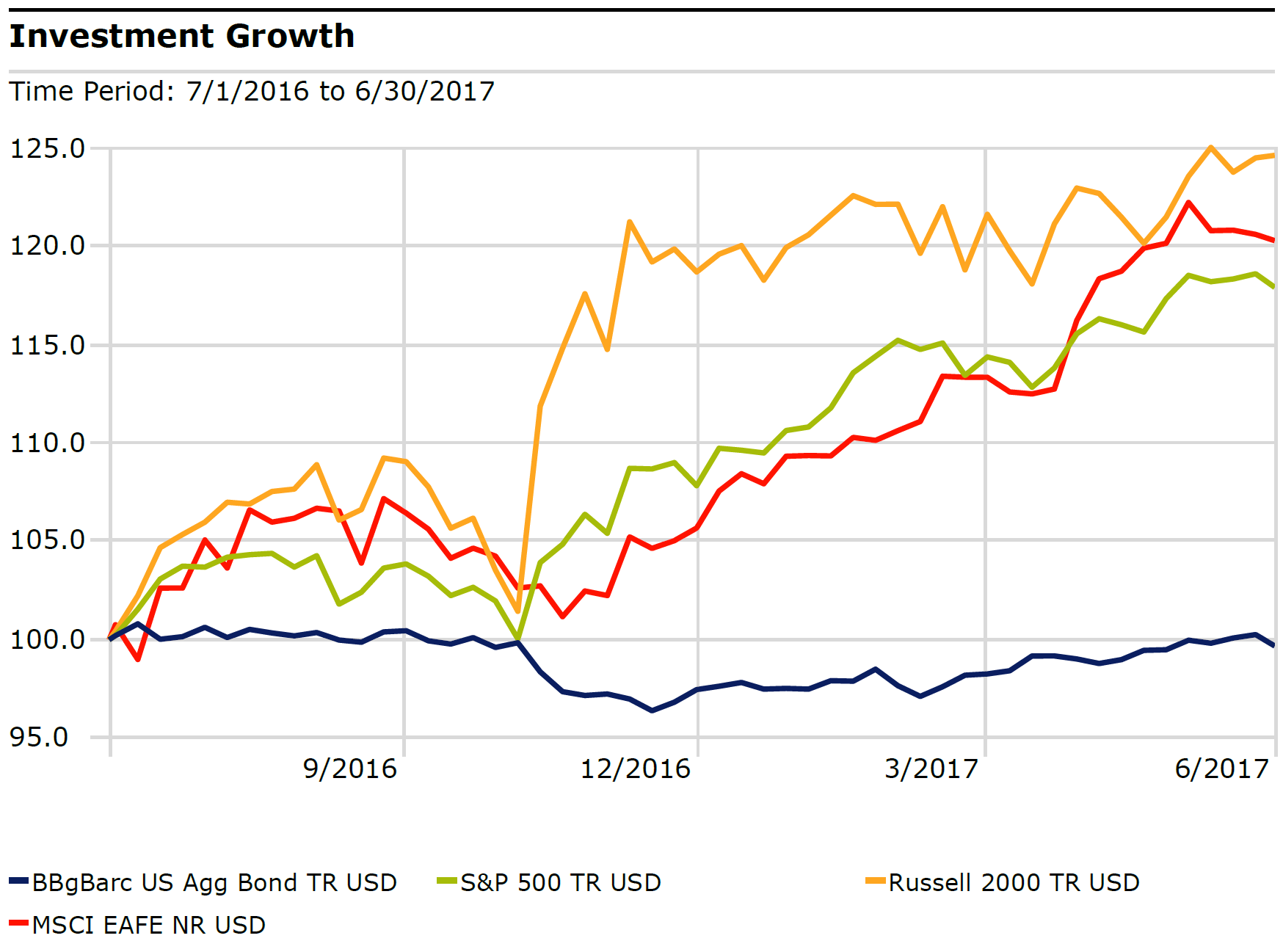

On a year-over-year basis, small-cap U.S. stocks, as measured by the Russell 2000, here, have a slight edge over foreign stocks.

click to enlarge

While it’s rarely a good idea to chase short-term performance, the trend of foreign stock outperformance that could continue—but this does not constitute investment advice—as foreign stocks remain relatively undervalued versus U.S. stocks using price-to-earnings and other valuation measures.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. The prices of small cap stocks are generally more volatile than large cap stocks.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.