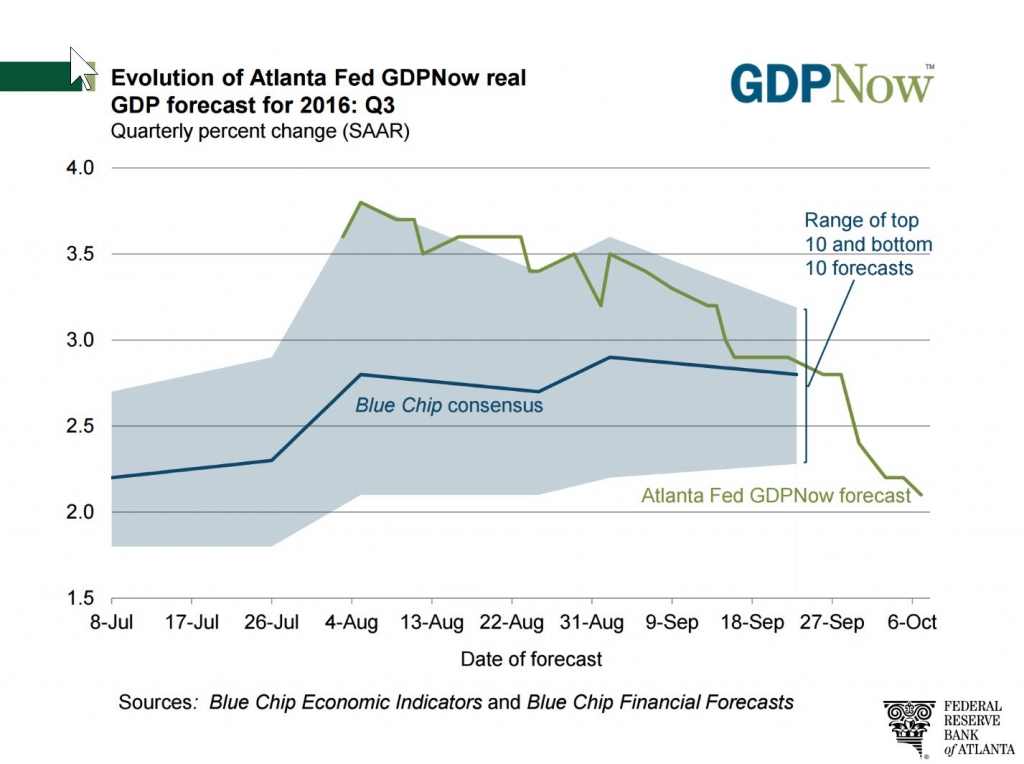

The economy continues to plod along. (I would include a picture of a plough horse here if it didn’t display the strength of the beast, as that’s not our economy.) We won’t get our first estimate of Q3 Gross Domestic Product (GDP) until the end of October, and we’ll get more revisions in the ensuing months, as much of the data is initially estimated. The Atlanta Federal Reserve produces its GDPNow figure, which is a high-frequency estimate of GDP, which is to say it uses data that comes our more frequently. It is on display below.

Its latest reading was 2.1%, which is, at least until a few weeks ago, below the lowest estimate of the so-called Blue Chip economists. Blue Chip is misleading, as it suggests high quality. While I’m sure the men and women of that surveyed group are high-quality folks, their estimates are anything but, having no more accuracy when forecasting, than would a group of elementary school kids. Regardless, this marks a considerable slow down in GDP growth, which those are addicted to low interest rates should appreciate, as it’s hard to argue the economy is overheating, when its trajectory looks like a Colorado black diamond ski run.

Harvard husband and wife economist team Reinhard and Rogoff said that this—sluggish growth—is what follows financial crises paired with recessions. Indeed, as Gene Epstein points out in the October 10, 2006, issue of Barron’s, at a 5% Unemployment Rate, it’s hard to argue that the U.S. is at anything but full employment. Even with full employment, though, the economy still plods along. As he puts it, the “economy’s sluggish state of growth can no longer be blamed on the underemployment of its available workers.” The labor picture is bright. The Labor Departments JOLTS (Job Openings & Labor Turnover Survey) reports that Job Opening are at an all-time high, while the voluntary Quit Rate continues to improve. Average Hourly Earnings are growing at about the fastest clip since the start of the recovery, but we’re still like an airplane that can’t hardly get off the runway.

In the Fort Wayne area, I drive by at least three major greenfield industrial developments, and existing homes that go up for sale routinely are on the market for only a couple of days before—in many cases—a submit-your-best-offer arises, and the house sells. Meanwhile, a friend who represents a major steel tubing producer says this has been has worst year ever. Something smells rotten in Denmark.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The economic forecasts set forth may not develop as predicted.