After what appears like what will be a spectacular year for U.S. stocks—the Standard & Poor’s 500 index is up by 27%+ as of this writing—a common thought for investors might be along the lines of will we give back some of the return next year, or, as the recent subject line of an email I received read, are we “borrowing from the future?”

Take that thinking a bit further, and one might be inclined to postpone the next dollar-cost-averaging or systematic investment purchase or maybe switch one’s 401(k) allocation to a cash or bond investment option—just temporarily, of course!

So, is next year destined to be a down year?

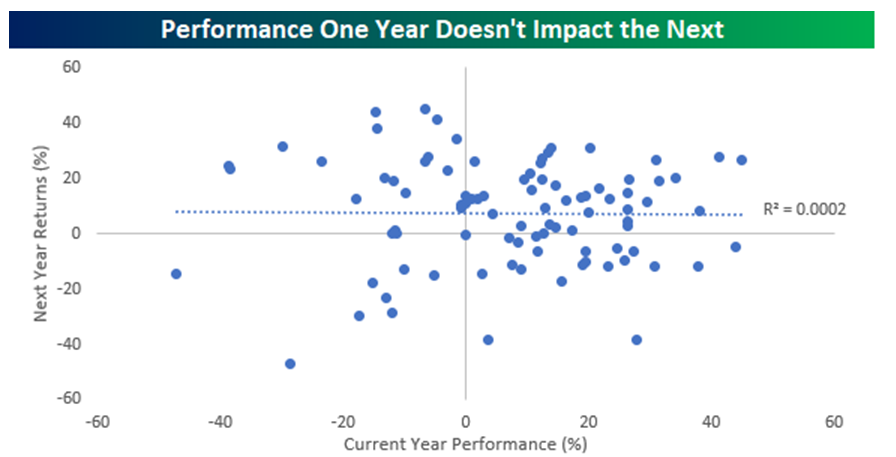

Should we expect to give some of 2019’s return back? The investment wizards at Bespoke Investment Group have crunched the numbers and found that “there is no clear trend that suggests returns for the remainder of the year or the following year were negatively (or positively) impacted.”

For the more analytically-minded among our readers, the correlation—R2—is about as close to zero (0.0002) as one can get.

This isn’t to suggest that one should be complacent about investments. Rather, the takeaway should be that one should stick to one’s long-term investment strategy and rebalance as assets ebb and flow.

Operators are standing by if you’d like to discuss this further.