The Ever-Stronger Dollar

There’s an old joke that’s kind of funny: during a time when the U.S. dollar is weak against other currencies, we see a patient at the end of a checkup sitting on the doctor’s table with his shirt off, and the doctor is saying: “You’re sound as a dollar. If you think about that for a minute, you’ll check right into the hospital.”

But today, ‘sound as a dollar’ is not just good news; it would be great news. The U.S. dollar, compared to other currencies, is more valuable today than it has been in two decades. For the first time, you can buy a Euro with a U.S. dollar on the currency markets, and very nearly buy a British Pound. That same dollar will buy 145 Japanese Yen, 60 Russian Rubles and 82 Indian Rupees. If you desire a lot of folding money, you can exchange that dollar for 42,350 Iranian Rials.

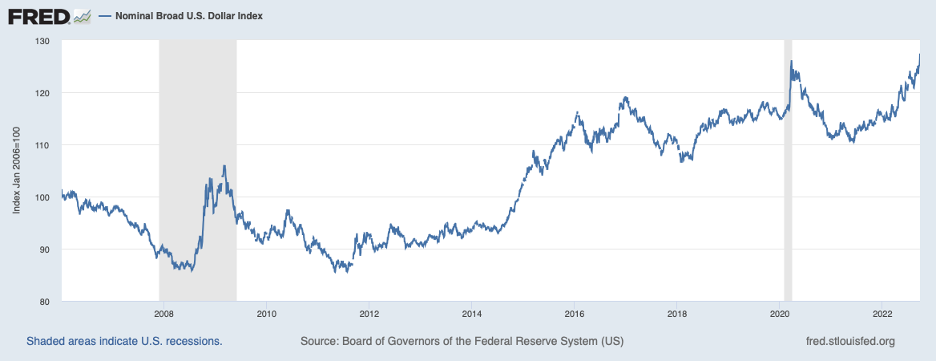

Overall, the U.S. Dollar Index, which measures the greenback’s ever-fluctuating value against a basket of significant trading partners, is up 20%—one of the few things that IS up this year. That’s good news for anyone buying imported products; they are proportionately cheaper than they were when today’s almighty dollar was merely strong. And traveling abroad is now less expensive than it was 12 months ago.

But a muscular dollar also carries an economic price. Anything manufactured in the U.S. and exported abroad has become roughly 20% more expensive this year, making American companies less price-competitive with companies that produce locally or in countries with cheaper currencies.

As you can see from the chart, above, the change in the dollar’s value has been a bit startling, and the ramifications abroad are only now starting to be felt. Emerging market countries that have debt denominated in dollars are finding it more expensive to make their interest payments. And, since most of the world’s commodities are priced in dollars, essentials like oil, wheat and soybeans are more expensive globally.

Will this trend continue? It could. Whenever the Fed raises interest rates—as it has several times in its attempt to reduce domestic inflation—the dollar picks up more value. A quick-and-dirty rule of thumb when it comes to currencies are that capital flows to where it gets the best, relative treatment. More rate hikes are expected, meaning an even stronger currency—and cheaper international trips for Americans—in the foreseeable future.

Behind the Employment Numbers

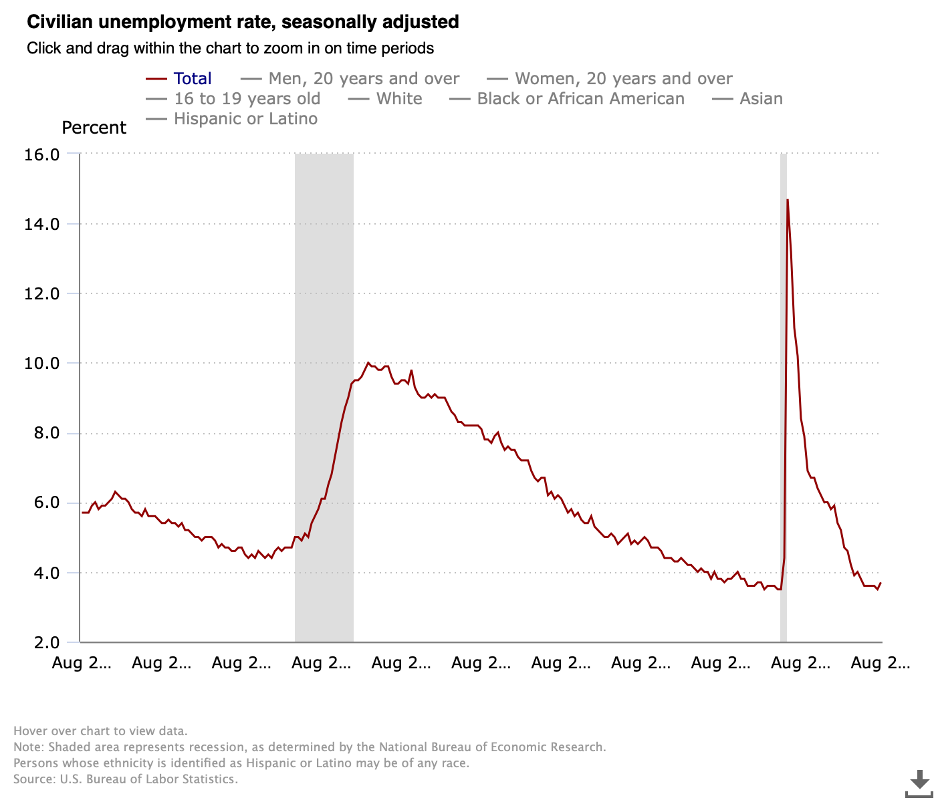

We read in the press that the U.S. unemployment rate is now 3.5%, which is historically very low, and indicates that most Americans can find a job these days. This is one reason why many observers don’t think the U.S. economy is in recession; typically, an economic slowdown means workers are laid off, not eagerly sought and hard to find. I would guess that the Fed won’t stop raising rates until they seem more softness in the labor markets, and the little blip you see below doesn’t constitute softness…yet.

The U.S. Bureau of Labor Statistics maintains a more detailed picture of U.S. employment on its website, and it shows that, as of last month, the overall civilian unemployment rate was 3.5%. The same is true for all men 20 years and older, and, interestingly, women 20 years and older seem to be slightly more employable, with just 3.3% of them out of work. It helps to remember that more than 10% of each of these groups was out of work in late 2008 and most of 2009, and unemployment also peaked briefly in early 2020 at around 15%.

When you look at some of the demographic breakdowns, one can see that some other cohorts are not as lucky, employment-wise, as white men and women. The unemployment rate of Hispanic and Latino members of the workforce is 4.5%, and 6.4% of Black or African-American workers are still looking for work in what is being described as an extremely tight job market.

Today, just under 20% of the people looking for work have been out of work for 27 weeks or longer (the BLS doesn’t track any further than that), which is roughly the historical average, although that number has been over 40% during times of recession.

Another statistic that is not generally reported on is the number of persons who are (for various reasons) not counted in the labor force, but who do want a job. The most recent statistics show 1.4 million people are looking in the window of the labor market, hoping to find a door, and of those, 366,000 are labeled as ‘discouraged workers,’ who believe that no jobs are available to them.

Fearlessly Awful Forecasts

Every year, right before January 1, you read a flurry of economic predictions for the coming year, published by the large investment banks and brokerage firms. These confident forecasts make it seem easy for people who are smart enough, with enough data and advanced degrees, to predict the future.

But when you look back on some of these confident, informed predictions, you see that there is a bit of a gap between what was forecast and what actually happened in the subsequent year. Take, for example, the J.P. Morgan 2022 Market Outlook, published December 15, 2021. The “key economic and market forecasts for 2022, from J.P. Morgan Global Research” tells us that the authors anticipate a bright future for investors in 2022, ‘with expectations of further equity market upside and above-potential growth.’ Earnings growth would be better than expected, according to the brokerage firm’s economists, and overall we would experience ‘a strong cyclical recovery… within a backdrop of still-easy monetary policy.’ The last part of that sentence bears noticing, since in actual fact the Federal Reserve has raised its Fed Funds rate fairly dramatically four times this year, 0.50% on May 5, and 0.75% on June 16, July 27 and September 21.

The breezy predictions included an above-average 3.7% GDP growth rate for the U.S. in 2022 (we are actually on track for negative growth overall for the year), and ‘market upside’ for stocks. The report predicts that the S&P 500 will reach 5050 by the end of the year (compared with roughly 3,500 currently), with 20+% returns—while, as most of us know, the markets are actually down more than 20% across the board.

Maybe it’s unfair to pick on just one brokerage organization, so let’s turn to the Merrill Lynch investment outlook published at the end of 2021, entitled ‘The Great New Dawn.’ Among other things, Merrill’s crack economic team predicted ‘above-trend’ economic growth’ and a ‘budding Equity culture’ which will drive ‘the secular bull market for years to come.’ U.S. stocks, Merrill customers were told in the report, will provide ‘a combination of growth, quality and yield characteristics. Profit margins,’ the report continues, ‘should also remain elevated for U.S. Equities.’ The report concludes that ‘the macroeconomic backdrop should remain supportive of equities.’

Around the same time as these reports were coming out, the forecasters at Citigroup published their ‘Outlook 2022’ white paper, entitled ‘The Expansion Will Endure: Seeking Sustained Returns.’ The brokerage firm’s sunny report predicts ‘continuing economic growth’ and (ahem) ‘moderating inflation.’ Later, in a slight elaboration, we are told that ‘global GDP growth will be solid,’ and ‘inflation is likely to retreat to tolerable levels in 2022.’ We know now that interest rates have exploded this year, so it looks almost silly to read Citi’s prediction that ‘interest rates will remain low or negative.’ Given the market downturn in 2022, what are we to make of Citigroup’s conclusive advice: ‘we believe the world economy and equity markets have not peaked and have room to grow’?

None of these economic teams foresaw a nasty bear market decline in the U.S. and global markets, the dramatic rise in interest rates or the economic slowdown we are experiencing now. Perhaps, in the future, whenever we read an economic report issued by the large brokerage firms, there should be a picture on the front of an economist wearing a wizard’s hat and robe decorated with half-moons, staring into a crystal ball or checking the patterns in the cracks of a burned tortoise shell.

Showing them reading the entrails of an animal sacrifice would be too messy.

Women’s Rights: A Long Journey

There’s been a lot of publicity around sexual harassment this year, and the MeToo movement seems to have brought us to a new age for women and their legal ability to navigate our social system. But it’s worth noting just how discriminatory our society—and others—have been toward women even in fairly recent times. Until the 2009 passage of the Lilly Ledbetter Fair Pay Restoration Act, women were not able to sue for the differences in discriminatory pay between their income and comparable men’s if more than six months had passed. The act was designed to address a Supreme Court decision entitled Ledbetter vs. Goodyear, where Lilly Ledbetter sued because, after decades of work, she discovered that her pay as a supervisor was lower than the lowest-paid man of comparable seniority. The Supreme Court denied her claim.

Until 1981, U.S. husbands were legally permitted to keep their wives in the dark about their family finances and to unilaterally take out second mortgages on property jointly held with their wives.

Here’s one that will startle younger persons: before the 1974 Equal Credit Opportunity Act, banks routinely required single, widowed or divorced women to bring a man along to cosign any credit application they made, regardless of their income.

America’s first female governor, Nellie Taylor Ross, was elected in Wyoming in 1924. In 1922, Rebecca Felton of Georgia became the first woman to become a U.S. Senator—at the age of 87. She served for one day.

Going back a ways, in 1872, Myra Colby Bradwell studied as her husband’s law apprentice and passed the Illinois bar. But when she tried to practice as a lawyer, the U.S. Supreme Court ruled that the state didn’t have to grant a law license to a married woman.

In 1862, a new California law was the first to establish that a woman who made bank deposits in her own name was entitled to keep control of the money—and that same year, the San Francisco Savings Union approved the first American banking loan to a woman.

Before 1839, no state allowed women to own property in their own names.

This is not to suggest that today the genders are equal in their social, economic or political standing; they clearly are not. But it does suggest that this new era in the relationship between genders is part of a longer, and long-overdue—progression of rights, privileges and respect.</p.

Source:

https://www.theguardian.com/money/us-money-blog/2014/aug/11/women-rights-money-timeline-history

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Pullbacks Galore

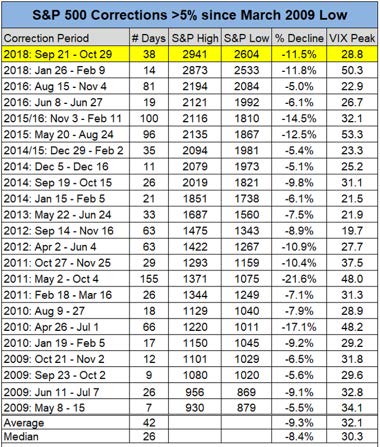

Nobody knows why the S&P 500 index declined more than 11% in October; the largest decline since, well, earlier this year.

But experienced investors know that these declines are not unusual. Since March 2009, the U.S. stock market has seen 23 pullbacks greater than 5%; eight greater than 10%. You can see all of them on the accompanying chart; on average, these pullbacks have lasted 42 days and dropped prices by 9.3%. And this is during a very long bull market!

Interestingly, the S&P 500 today isn’t the same as it was back when the current bull market began; in fact, there are only 337 stocks remaining in the index that were included on March 9, 2009. A small number—just 38 of them—accounted for much of the runup in the index, each gaining more than 1,000%, led by amazon.com, which has gained 2,350%, or nearly 40% a year. Amazon is currently 25% off its highs—its fifth drawdown of 20% or more since 2009.

Is there a lesson here? Alas, we can’t extrapolate the short-term future from these statistics. When stocks go on sale, it is often difficult to determine whether they will become even better bargains in the days ahead.

Sources:

https://theirrelevantinvestor.com/2018/10/30/a-top-or-the-top/

https://pensionpartners.com/the-5-kinds-of-bounces/

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries

Real Estate Sales: Down. Prices: Up

You may have read that there has been a drop in new home sales—down 13% in September compared to the previous September—and that, combined with the drop in stock market values, might have you worried about the state of the U.S. economy.

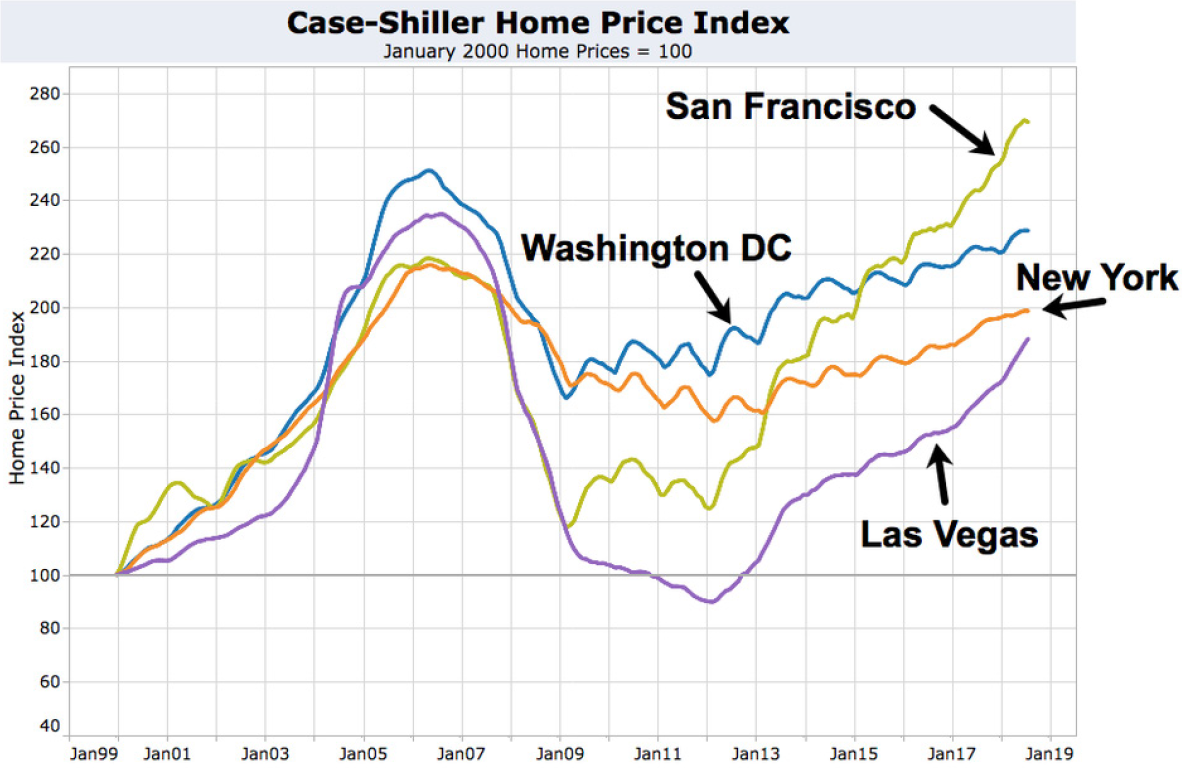

It’s true that a decline in the housing market has been an indicator, in the past, of a future decline in overall economic activity. But at the moment, this particular index is sending decidedly mixed signals. While housing sales are down, housing prices have been going up. The Case-Shiller index shows that home prices have been increasing in all 20 cities covered by the index, and in the U.S. as a whole. Las Vegas home prices rose a scorching 13.9% in August (when the most recent data is available), while San Francisco (up 10.6%) and Seattle (up 9.6%) have been strong as well. At the other end of the scale, New York and Washington, D.C. homes are “only” selling for 2.8% more than they did a year ago.

The accompanying chart shows that both San Francisco and Las Vegas suffered the most during the long downturn that began in 2008, and therefore had the most opportunity to experience recovering growth. But the graph doesn’t show any clear warning signals that a recession is on the horizon; if anything, we are starting to see record prices, suggesting that people are able to afford more expensive homes.

However, one area where the housing market has cooled down dramatically is ocean front property. A recent New York Times article notes that people living on the beach are having trouble getting people to even look at their listed properties. Why? Global warming has caused oceans to rise and coastal areas to flood, plus fiercer floodwaters, winds, and hurricanes—and nobody expects the problem to go away any time soon. As a result, buyers see properties along the shore as a risky investment and are opting for homes three or four houses off the water.

Sources:

https://www.wsj.com/graphics/coastal-home-sales-affected-by-climate-change-worries/

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Open Enrollment: Pay Attention

We are now in open enrollment on the government (39 states) or state health insurance exchanges (11 states and the District of Columbia)—so this is the time of year when consumers can buy health insurance coverage under the Affordable Care Act. In most states, the enrollment season lasts six weeks—half as long as it used to—and many people are wondering whether the ACA is still viable. Hasn’t the Trump administration taken steps to make it easier for healthy individuals to opt out of ACA and buy cheaper coverage that lacks certain popular consumer protections? Doesn’t the economics of covering pre-existing conditions require that all insurance buyers participate in the overall pool of insurance premiums?

There is no question that the alternative, cheaper policies endanger pre-existing coverage in the long term, and many insurance carriers are publicly rethinking their rate policies. But the Affordable Care Act has been surprisingly resilient so far, with 11.8 million Americans signed up for coverage. Insurance companies, for the first time, have reinforced their commitment to the existing system by dropping their rates by an average of 1.5%—though there is wide variation among states. Residents of Tennessee will see a 26% overall decline in the benchmark silver plans, while Pennsylvania residents will experience a 16% decrease. In North Dakota, rates will rise an average of 21%.

In 15 states, insurance companies are returning or entering for the first time, and the total number of providers is up to 155, from 132 last year. That means consumers will have more options. Established insurers like Anthem and startups like Oscar and Bright are providing coverage because, thanks to a big increase in premiums last year and the possibility that Congress will stall a full ACA repeal going forward, they believe they can scratch out a profit.

Taking the time to navigate the different options can save some consumers thousands of dollars. For instance, many companies are offsetting their rising costs by offering high-deductible, low-premium plans along with health savings accounts (HSAs). An HSA contribution is triple-tax-advantaged: it is deductible when you make the contribution, the money grows tax-deferred, and if you take the money out to pay for medical costs, it comes out tax-free. Any money not used in a calendar year is rolled to the next.

At the other end of the spectrum, people who have developed a chronic condition, or who are older, might fare better with a low-deductible plan. They pay a higher premium each month, but the lower deductible will reduce the amount they will have to pay out-of-pocket for medical procedures. If you buy insurance through an employer, the low-deductible policy can be combined with a flexible spending account, or FSA, where a policyholder contributes pre-tax dollars to pay qualified medical expenses during the year. Any FSA money left over will be forfeited.

There are a lot of issues to consider, which means it might be better to hire an expert than to try to navigate your options on your own. But you have to beware where you get your advice. The Trump administration cut the funding for the ACA’s “navigator” program from $37 million to $10 million. Basically that means there will be fewer sources of impartial advice. Administration officials, instead, are pushing consumers toward sites operated by insurers and for-profit (and sales-oriented) web brokers, who may not provide all the options available to consumers. Getting advice from an “advisor” with a sales agenda is no wiser in the health markets than it is in the investment world.

Sources:

https://www.cnn.com/2018/10/31/politics/obamacare-open-enrollment/index.html

https://www.ehealthinsurance.com/resources/affordable-care-act/2019-open-enrollment-dates-state

Boring Bonds Come Alive

Bonds are boring, right? Stocks jump up and down and all over the place, and over several years they might even jump 100% in value. Meanwhile, the bonds in your portfolio crank out predictable coupon yields quarter after quarter after quarter.

If you’re bored by the bond market today, then you may not be paying attention. Year to date, while stocks are bouncing around at prices roughly where they were in early 2018, a sharp fall in bond yields has caused bond investors to reap some significant capital gains.

How significant? Since the beginning of 2019, investors in the 30-year Treasury bond have seen gains (interest plus price appreciation) of 26.4%—which would be a great full year’s return for stocks. Long-term bonds overall have generated a 23.5% return, as represented by the Bloomberg Barclay’s U.S. Aggregate Bond Index. Investment grade corporates have returned a not-too-shabby 14.1%, while the 10-year Treasury note has gained 12.6%.

The yield drop that caused these returns is actually jaw-dropping for market observers, who have been predicting for roughly a decade that bond rates have nowhere to go but up. The yield on the 10-year Treasury note is now just under 1.47%; it was more than 3% at the end of 2018.

Will we see more of the same? It’s very hard to imagine that same 10-year Treasury falling another 1.5%—to zero yield. The smart money says that most of the gains have already been taken, and anybody looking for 20+ percent returns in long bonds going forward is just chasing returns after the fact. Remember, any asset that can jump 20% in a little more than half a year can do exactly the same thing—or more—on the downside.

The lesson here is that if you think of bonds as the boring part of your portfolio, then understand that there are times when they can add a little more kick to your returns than you might have expected. And there is a significant chance that they’ll give back those returns as rates stabilize and increase at some point in the future.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Recession Talk

Whenever you talk about recessions, it’s important not to be alarmist. Because it is very hard to time a recession (that is, know precisely when it will begin and end), and because it is even harder to know when the stock market will decline and rise again in association with a recession, it is generally best to simply ride out these periodic downturns with a consistent asset allocation. After all, in every circumstance so far, the economy and the markets have eventually recovered to post new highs. Nobody is guaranteeing that, of course, but so far the track record has been good.

Nobody would be surprised to see the U.S. fall into an economic recession sometime in the next 18 months. A recent article in Forbes magazine laid out the clouds that economists are watching on the near horizon.

The biggest of these is an unusual slowdown in global trade these past two years. Indeed, trade growth has been essentially zero this year, and the Forbes article points directly to the trade wars between the U.S. and China, between the U.S. and Europe—and doesn’t specifically mention another significant trade war brewing between South Korea and Japan. At the same time, the Trump Administration has been “interfering” [the magazine’s term] with the global currency markets, changing the rules to make it easier to label a country a currency manipulator at the same time the President has been demanding that the U.S. Fed cut interest rates to weaken the dollar and make U.S. exports more competitive. Global companies are no longer sure who they can invest in or where, and so they have held back on capital investments until the uncertainty passes—and when will that be?

At the same time, the article notes, periods of uncertainty tend to bring nervous capital rushing to the relative stability of the American currency, driving up the value of the dollar and making American exports less competitive on the world markets. U.S. corporate profits declined consecutively in the first two quarters of this year, including an alarming decline of 2.8% in the second quarter, according to statistics compiled by the Bloomberg organization. Small companies, which tend to carry more debt than large ones, appears to be faring worse.

And then there’s the yield curve. There was a very brief inversion of the curve several months ago which triggered headlines, but you don’t hear many people talking about the strange upside-down nature of the bond market today. At this moment, you can get paid more for investing in 3-month Treasuries (1.98% yield), than you can if you take more risk and go out six months (1.86%), and you get still less at 12 months (1.72%), 2-year (1.49%) and 5-year Treasury bonds (1.36%). That suggests that bond investors are trying to lock in very low rates for longer periods of time, a sign that they’re unsettled about the future of the economy.

None of this means that a recession is inevitable, of course. According to the Journal of Accountancy, Americans’ personal satisfaction levels are near their all-time highs (according to the AICPA’s Personal Satisfaction Index), and the most recent Business & Industry Economic Outlook Survey shows that U.S. business leaders are more confident about the domestic economy than the global economy. But the fact that one of America’s leading business magazines is uttering the dreaded “R” word to its readers suggests that it is never a bad idea to make sure you’re comfortable with your current asset allocation, and willing to weather a market storm whenever it may come.

Negative Yields in Our Future?

Let’s suppose somebody came to you with a proposal. You would lend this person $100 for a couple of months. Because this person was doing you the favor of keeping your $100 safe for a period of time, he proposes to only pay you back $95. In effect, he has paid you a negative interest rate for the privilege of lending him money. Or, put another way, you’ve paid him for the privilege of loaning him money.

What kind of obvious scam is that? It might surprise you to know that some of the world’s largest banks are lending their assets under similar circumstances, and these are institutions you may have heard of: the Bank of Japan, the European Central Bank, and the state banks of Sweden, Switzerland and Denmark. Basically, they were taking deposits with a promise that the lenders wouldn’t get all their money back.

Negative interest rates came on the global financial scene in 2016, and at the peak, some $12.2 trillion were loaned at negative rates. The negative rate concept evolved as a policy that would punish lending institutions for simply parking their money and earning interest instead of making the loans that would stimulate the economy. In theory, negative rates also reduce borrowing costs for companies and households, driving up demand for loans. But what if banks start passing on the negative rates to their traditional depositors, in effect charging them a fee in return for holding their cash (and lending it out, and profiting on it)? Customers would respond by simply putting the money in their mattresses instead, and generate a higher return (0%) than they would get at the bank.

The longest-running experiment with negative rates is taking place in Denmark, where two large financial institutions—Jyske Bank and Syndbank—now “offer” -0.6% on retail deposits bigger than $1.1 million. Over the last seven years, these and other banks have declined to pass these negative rates on to their depositors. The result is predictable. In July, Danish bank deposits equaled roughly $140 billion, which are then deposited in a central bank account at -0.60% or invested in negative-yielding securities. The banks are reportedly under financial stress that gets worse every year. It turns out (surprise!) that locking in a negative return on your investments isn’t a profitable business.

Could negative rates happen here? The U.S. Fed sets rates at the short end of the yield curve, and they are currently a rather robust 2.25%—which means banks can simply park their cash and earn more than they would if they invested in 30-year Treasuries (an astonishingly low yield of 1.97% currently). If the U.S. experiences a recession, that rate will go down; how far will depending on how alarmed Fed economists become. In December 2008, at the bottom of the Great Recession, that rate came all the way down to 0.25%.

But it’s worth noting that the Fed, this time around, would have to start its cuts from a lower initial rate, which means taking rates down to 0.25% won’t have the same effect as they did in the last recession. If it were necessary to cut rates as aggressively in the next recession as the Fed did in the last one, that would certainly suggest negative rates in our future—and the U.S. would join a very big club around the world.

Life Hacks That Will Save You Time

Navigating our day-to-day lives is not easy, and not always because we face huge transcendent challenges. It’s the little annoyances and difficulties that persistently get in our way and frustrate our plans and schedules.

But over time, people have come up with ingenious ways to overcome at least a few of those small challenges—and a website called homehacks.com routinely collects these tips and ideas from its readers. Some of them are easy, like, when you find yourself trying to spread cold butter on a piece of bread, instead try rubbing the butter against a cheese grater to make it more spreadable. Or if you’re trying to tighten or remove a stripped screw; try putting a rubber band between the screwdriver and the screw head, to make the screw easier for the screwdriver to grip. (Who knew?)

Want more? If you need to chill your white wine that was poured (ugh!) at room temperature, instead of dropping an ice cube in the wine glass and destroying the flavor, drop in a few frozen grapes. If you need to top off the oil in your car’s engine but don’t have a funnel, hold a screw driver over the opening and pour the oil down the blade of the screwdriver—and avoid spilling even a drop.

Are your eggs fresh? How would you know just by looking at them? You can get a definitive answer by dropping the eggs in a container of water. The fresh ones will sink straight to the bottom. But if the eggs are going bad, they’ll float at least halfway up the container.

Have you ever rented a car, and pulled into a gas station, and then suddenly found yourself wondering which side of the car the gas tank is placed on? You can tell by looking at the direction of a little arrow in the middle of your fuel gauge that you probably never noticed before. It points to the side where you can fill the tank. Another hack: leaving a tea bag in your sneakers overnight, to eliminate smelly foot odor.

Suppose you lose an earring or other small piece of jewelry somewhere in the carpet? Wrap pantyhose around the face of the vacuum attachment, and run the vacuum over the carpet. Have you ever gone on the road and realized that you forgot the charging dock for your phone? Relax! Most hotel televisions have a USB port on the side.

Peeling boiled eggs can be a real hassle. But not if you drop the boiled eggs in ice water before peeling. The shells will slip right off. Want a super-secure password? Insert a character that isn’t used in the English language, like ñ or ß. Trying to find and peel off the edge of a roll of packing tape? Every time you finish with the tape, mark the edge with a paper clip, which holds the end of the tape above the roll so you can get at it easily.

Are you the kind of person who hits your fingers with a hammer when you’re driving a nail into the wall to mount a picture? Use a clothespin to hold the nail in place while you hit it with the hammer. The site also recommends that you clean your toilet with coca cola (the powerful carbonation dissolves grime and also removes rust), that you polish your car’s headlights with toothpaste, and that you color-code your many keys with different colored nail polish, so you always know which key fits into which lock. You can also put all your charger cords and plugs into a glasses case when you travel, and use a lint remover roller to clean your window screens. Who knew?

Seven Ways to use Emotional Intelligence to Beat Procrastination

You have a project that absolutely has to get done, but there are so many distractions that you’re making little to no progress. How can you get an upper hand on procrastination? The Fast Company website offers seven handy tips from successful readers. You may not relate to all of them, but any two or three might get you to the finish line.

First, tie the task at hand to a larger goal that you’re passionate about. That way, you know you’ll get a positive charge from the outcome. For example: if you complete this important report, you’ll be one step closer to getting that promotion you crave. The report becomes a stepping-stone to advancement.

Second: consider starting the project with the easiest part. If you’re trying to get your head around the entire project, you might feel defeated before you begin. But know that you can actually start anywhere, and get some progress down—which will eliminate some of the emotional resistance to tackling the rest of the project. Once you’ve gotten some of the project finished, you will get on a roll, where you have the momentum to keep going.

Third: break the task down into small chunks. You will spend the next five minutes working on a piece of it, and get the satisfaction of completing a part of the whole project. Then you can devote the next five or ten minutes to another chunk, and focus only on that piece of the puzzle.

Fourth: unplug, disconnect and put a hold on everything that could potentially disrupt your focus.

Fifth: Select an environment that fits your style of work.

Sixth: set up a system of rewards. If you spend a productive hour on the project, promise yourself a creamy double mocha latte. Savor the reward, and also feel satisfied that you’re one hour closer to completion. Make the reward something you wouldn’t normally give yourself or do for yourself.

Seventh: overcome the need to be perfect. The fear of creating an imperfect project can make you paralyzed and unable to begin. Think of the times in your life when you failed, but changed direction and succeeded in the end. Or give yourself permission to do great (if imperfect) work initially, and then clean up any imperfections at the end.

Instilling Discipline in Your Daily Life

You already know that life is full of distractions, from your phone, to email, to the Internet, to people who stop by to chat while you’re working. Successful people have developed a few tricks to instill discipline in their daily lives.

First: keep a schedule. That tells you want you need to focus on and accomplish each day. Record your upcoming meetings and appointments, log in the projects you want to finish, and then mark them complete upon completion—which will give you a tangible sense of accomplishment and help you feel more organized and disciplined. At the same time, set aside time for routine activities, like the early morning for expense reports.

Second: include exercise in your schedule. Physical discipline can help you be more mentally disciplined.

Third: know when to stop. The work will still be there tomorrow, and unfinished business is better than doing bad work. Move on to the next thing and stay on schedule.

Finally: don’t strive for perfection. If you chase an ideal, you will constantly feel like you’re failing. Be content with doing the best you can and move on.