I think it’s fair to say that investors are more likely to make—or want to make—changes to their investment portfolios when things are going badly, rather than when they’re going well. If things are going in the right direction our thoughts are that changes might mess that up. On the other hand, that same thought process, applied to a badly-performing portfolio, might encourage us to make changes.

Unfortunately, a portfolio that is performing badly—producing minus signs, let’s say—affects the part of our brain where the fight-or-flight response resides, rather than the rational, thinking part of our brain. The fight-or-flight side says, “this is painful; relieve the pain,” while the rational side of our brain—if the other side wasn’t muffling it—might say, “easy now; this has happened before; take a deep breath.” You want the rational side of your brain operating at such times.

But that’s tough to do. This is my 23rd year in the investment business, and my fight-or-flight response still kicks in, and I can’t command the other side of my brain to take over. I just don’t allow myself to make investment changes at times like those.

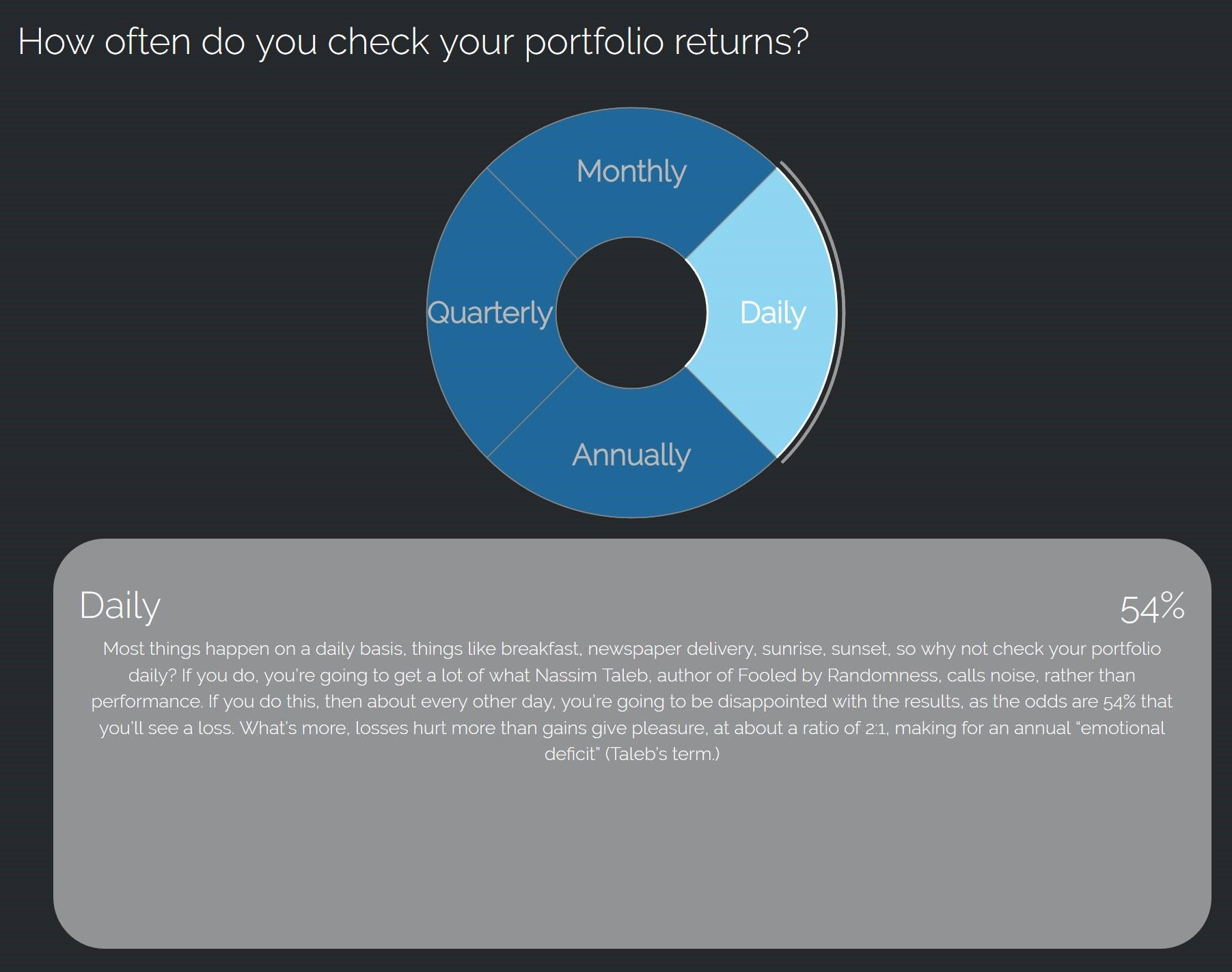

A different approach is to look less frequently at your account. If minus signs create anxiety, the longer we wait, the less likely we are to see minus signs, based on historic performance. So, if one was to go to a desert island for 20 years and come back, history suggests there is almost no chance of seeing a minus sign for a diversified stock portfolio. Making this a bit more realistic, the odds of seeing a minus sign are far higher when we check on a daily basis versus a quarterly basis, and even if we don’t make changes, there’s an emotional cost of seeing minus signs.

On our website, we have a tool that can help quantify the odds—and even the emotional costs—of checking on a portfolio/account on different frequencies. Keep in mind, of course, that the tool uses estimates, which are almost always wrong, but the fact remains that, regardless of the estimates, more frequent checking is more likely to reveal minus signs than is infrequent checking. Click on the image below to be taken to the Wheel simulation.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. No strategy assures success or protects against loss.