Mind Your Fees and Qs

A story in the Wall Street Journal announced that a prominent investment firm (PIF) would be reducing its maximum account-level, asset-based fees on accounts less than $1 Million from 2.7% to 2.2%. That sounds like a lot to me. It’s no way to retire when one considers what future returns might look like.

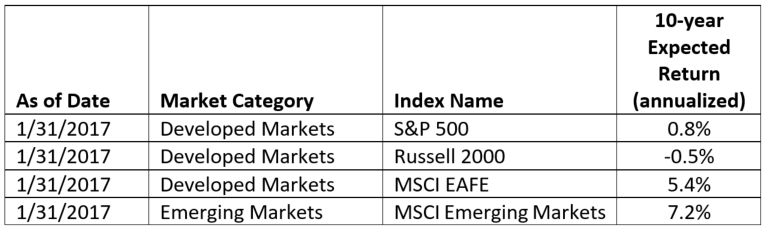

Research Affiliates (RA) produces 10-year real—i.e. inflation-adjusted—return estimates based on the Shiller P/E ratio and the tendency of valuations to mean revert. The Shiller P/E is an alternate measure of the price:earnings ratio that uses long-term earnings in the denominator instead of the more traditional trailing 12 months.

Here is a scatterplot from the RA website that plots volatility on the horizontal axis and returns on the vertical axis. See it for yourself here.

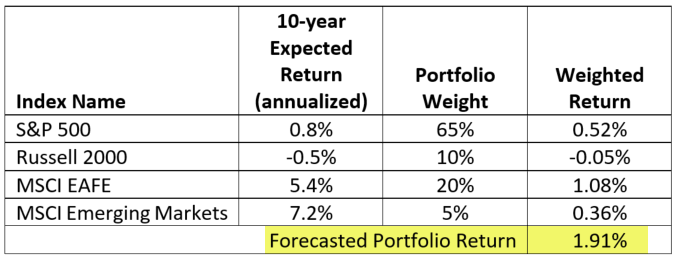

Here’s the trouble with PIF’s apparent magnanimity: a global portfolio constructed by the typical U.S. investor will be hard pressed to return more than the annual fee, based on the RA data. Featured in the pie chart nearby is a hypothetical allocation for a U.S. investor. It features 25% in foreign stocks—about half the world’s actual allocation to foreign stocks—65% in U.S. large-cap and 10% in U.S. small-cap stocks.

[visualizer id=”306″]

Next, let’s look at the returns that RA forecasts for each of these areas.

… apply hypothetical portfolio weights to them…

…and deduct PIF’s fees…1.91% – 2.20% = -0.29%, which is no way to reach one’s retirement goals.

If you check out Research Affiliates’ website (link above), you will find that there are markets with forecasted returns—well, at least a couple: Turkey and Russia—and Poland comes close at 9.7%. Anyone…anyone…

It’s possible, by reallocating our proposed portfolio, to pursue a return approaching 5%, but with a lot of anticipated volatility. But even at 5%, and with the prominent investment firm fee reduced to 2% for easy math, that still means that 40% of the return is being eaten up by fees.

Investors are going to have to mind their fees and ask lots of Qs to avoid giving up their returns in the form of fees.

Graig Stettner, CFA

Financial Advisor & Partner

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing involves risk including loss of principal. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The prices of small cap stocks are generally more volatile than large cap stocks.